Learn about The Bahamas Ministry of Finance including our ESG Information, News & Press Releases, Policy & Strategy, and Team and Contact Information.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Learn about The Bahamas Ministry of Finance including our ESG Information, News & Press Releases, Policy & Strategy, and Team and Contact Information.

About The Bahamas Ministry of Finance

- Population

- 407,906

- GDP

- 15.8 Billion B$

- Projected 2025/26 Surplus

- 448.2 Million

The primary responsibility of the Ministry of Finance is the care and management of the Government’s financial resources. This responsibility involves providing support and advice on the most appropriate fiscal, tax and economic policies with the aim of maximizing sustainable economic growth and development with full regard to equity and social policies. The development and management of the Government Budget is a major aspect of the Ministry’s function.

ESG Information

Learn about our environmental, social, and governance program, and how we bring those values to life

News

Source: Ministry of Finance, The Bahamas

Date: February 25 2026

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal

operations for the month of December 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, total revenue collections were estimated at $233.6 million,

representing a $15.5 million (6.2 percent) decline compared to the same period of the previous year. Tax revenue decreased by $13.5 million (5.7 percent), primarily reflecting lower collections from international trade and transactions, value-added tax, and taxes on the use and permission to use goods. These declines were partially offset by higher, timing-related receipts from taxes on specific services. Non-tax revenue totaled $37.3 million, a $3.0 million (7.5 percent) year-over-year reduction, largely attributable to lower rental income and reduced receipts from work and resident permits.

On the expenditure side, recurrent spending increased to $304.7 million, a $31.6 million (11.6 percent) rise compared to December 2024. This outcome was driven mainly by a significant rise in public debt interest payments, alongside higher outlays for subsidies and personal emoluments. Capital expenditure rose by $7.9 million (40.2 percent) to $27.5 million, reflecting increased spending on the acquisition of non-financial assets and capital transfers.

As a result of these developments, the Government recorded an overall fiscal deficit of $98.6 million for December 2025, compared to a deficit of $43.6 million in the corresponding month of the prior year. During the month, central Government debt outstanding increased by an estimated $73.4 million, reflecting borrowing activity associated largely with domestic financing.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: February 25 2026

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal

operations for the month of November 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $189.0 million, a 25.4 percent decrease from the prior year, with the tax component tapering by $68.9 million to $161.6 million. Key contributors for this shortfall were taxes on property ($8.7 million), taxes on international trade and transactions ($38.2 million) and value added tax ($12.5 million). Non-tax revenue rose by $4.7 million to $27.4 million, due to collections of customs and immigration fees.

Aggregate expenditure settled at $271.9 million, with the recurrent and capital components at $256.3 million and $15.6 million, respectively. The year-over-year $38.2 million reduction was largely explained by the reduction in outlays for public debt interest ($23.5 million) as the prior year’s liability management operations shifted the monthly payments schedule. Subsidies were also lower by $5.3 million.

As a result of the above movements, the Government’s overall fiscal position for November 2025 recorded an estimated deficit of $82.9 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $41.7 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Central Communications Unit, Ministry of Finance, The Bahamas

Date: February 19, 2026

Contact: MOFcomms@bahamas.gov.bs

In keeping with Section 61 of the Public Debt Management Act, 2021, the December 2025 Public Debt Statistical Bulletin (“PDSB”) represents the eighteenth official report on public debt statistics in The Bahamas prepared by the Debt Management Office (the “DMO”) of the Ministry of Finance.

At end-December 2025, public sector debt outstanding was estimated at $13,885.9 million, reflecting increases of $321.4 million (2.4 percent) compared with end-September 2025 and $699.7 million (5.3 percent) relative to the same period in the previous year. The quarterly movement was mainly driven by an expansion in the central Government the debt stock of $337.3 million (2.8 percent) to $12,406.8 million—for an estimated 75.1 percent of GDP. Conversely, the combined debt of Agencies and Government Business Enterprises declined by $16.0 million (1.1 percent) to $1,479.1 million.

Since end-September 2025, external public sector debt rose by $223.2 million (4.0 percent) to $5,736.0 million, advancing its share of the total portfolio by 0.7 percentage points to 41.3 percent. This growth was largely associated with increased liabilities to multilateral agencies of approximately $240.6 million, with smaller variations posted across financial institutions, private capital market and bilateral creditors.

Over the same period, the domestic component of public debt expanded by $98.3 million (1.2 percent), to $8,149.9 million at end-December 2025. Growth was primarily due to additional claimsfrom the private sector ($90.7 million) and commercial banks ($45.5 million), which was partially offset by reductions in obligations to the Central Bank ($19.3 million) and public corporations ($17.8 million).

In terms of currency composition, 56.3 percent of the public sector debt stock was denominated in Bahamian dollars, 38.5 percent in U.S. dollars, and 5.2 percent in other foreign currencies. Regarding interest rate exposure, fixed-rate instruments accounted for 66.0 percent of the portfolio, and variable- rate debt the remaining 34.0 percent.

The Government remains committed to transparency and accountability in debt management activities and invites stakeholders to visit the national Budget Website (www.bahamasbudget.gov.bs) to view the various published reports.

Policy & Strategy

Team and Contact Information

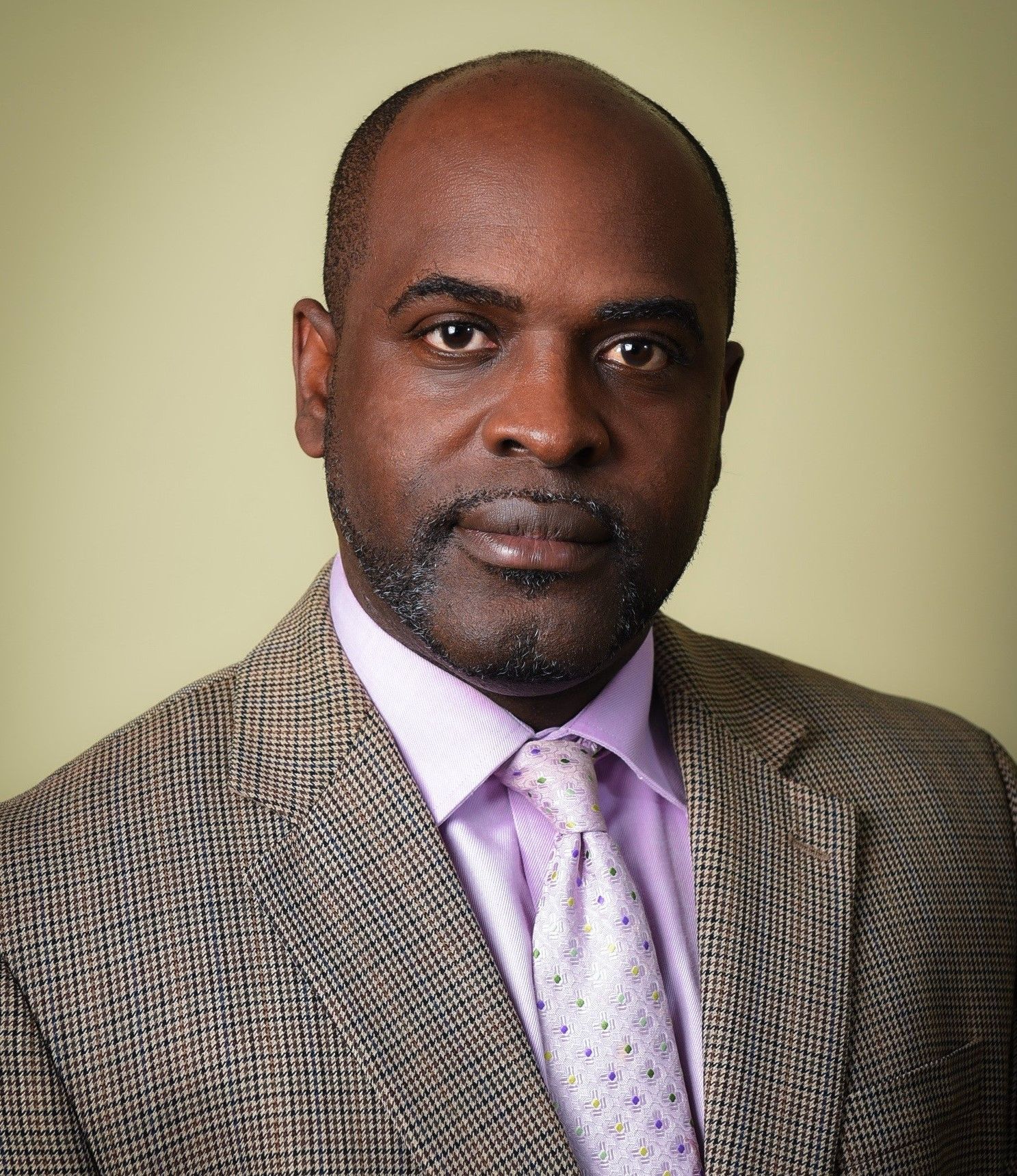

Philip Edward Davis

Michael B. Halkitis

Simon Wilson

Gia Cartwright

Christine M. Thompson

Joycelyn Gilbert

Contact Information

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.