Learn about the latest News & Events for The Bahamas Ministry of Finance, and sign up to receive news updates.

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Learn about the latest News & Events for The Bahamas Ministry of Finance, and sign up to receive news updates.

Upcoming Events

No upcoming events. Add this issuer to your watchlist to get alerts about important updates.News & Press Releases

Source: Ministry of Finance, The Bahamas

Date: February 25 2026

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal

operations for the month of December 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, total revenue collections were estimated at $233.6 million,

representing a $15.5 million (6.2 percent) decline compared to the same period of the previous year. Tax revenue decreased by $13.5 million (5.7 percent), primarily reflecting lower collections from international trade and transactions, value-added tax, and taxes on the use and permission to use goods. These declines were partially offset by higher, timing-related receipts from taxes on specific services. Non-tax revenue totaled $37.3 million, a $3.0 million (7.5 percent) year-over-year reduction, largely attributable to lower rental income and reduced receipts from work and resident permits.

On the expenditure side, recurrent spending increased to $304.7 million, a $31.6 million (11.6 percent) rise compared to December 2024. This outcome was driven mainly by a significant rise in public debt interest payments, alongside higher outlays for subsidies and personal emoluments. Capital expenditure rose by $7.9 million (40.2 percent) to $27.5 million, reflecting increased spending on the acquisition of non-financial assets and capital transfers.

As a result of these developments, the Government recorded an overall fiscal deficit of $98.6 million for December 2025, compared to a deficit of $43.6 million in the corresponding month of the prior year. During the month, central Government debt outstanding increased by an estimated $73.4 million, reflecting borrowing activity associated largely with domestic financing.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: February 25 2026

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal

operations for the month of November 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $189.0 million, a 25.4 percent decrease from the prior year, with the tax component tapering by $68.9 million to $161.6 million. Key contributors for this shortfall were taxes on property ($8.7 million), taxes on international trade and transactions ($38.2 million) and value added tax ($12.5 million). Non-tax revenue rose by $4.7 million to $27.4 million, due to collections of customs and immigration fees.

Aggregate expenditure settled at $271.9 million, with the recurrent and capital components at $256.3 million and $15.6 million, respectively. The year-over-year $38.2 million reduction was largely explained by the reduction in outlays for public debt interest ($23.5 million) as the prior year’s liability management operations shifted the monthly payments schedule. Subsidies were also lower by $5.3 million.

As a result of the above movements, the Government’s overall fiscal position for November 2025 recorded an estimated deficit of $82.9 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $41.7 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Central Communications Unit, Ministry of Finance, The Bahamas

Date: February 19, 2026

Contact: MOFcomms@bahamas.gov.bs

In keeping with Section 61 of the Public Debt Management Act, 2021, the December 2025 Public Debt Statistical Bulletin (“PDSB”) represents the eighteenth official report on public debt statistics in The Bahamas prepared by the Debt Management Office (the “DMO”) of the Ministry of Finance.

At end-December 2025, public sector debt outstanding was estimated at $13,885.9 million, reflecting increases of $321.4 million (2.4 percent) compared with end-September 2025 and $699.7 million (5.3 percent) relative to the same period in the previous year. The quarterly movement was mainly driven by an expansion in the central Government the debt stock of $337.3 million (2.8 percent) to $12,406.8 million—for an estimated 75.1 percent of GDP. Conversely, the combined debt of Agencies and Government Business Enterprises declined by $16.0 million (1.1 percent) to $1,479.1 million.

Since end-September 2025, external public sector debt rose by $223.2 million (4.0 percent) to $5,736.0 million, advancing its share of the total portfolio by 0.7 percentage points to 41.3 percent. This growth was largely associated with increased liabilities to multilateral agencies of approximately $240.6 million, with smaller variations posted across financial institutions, private capital market and bilateral creditors.

Over the same period, the domestic component of public debt expanded by $98.3 million (1.2 percent), to $8,149.9 million at end-December 2025. Growth was primarily due to additional claimsfrom the private sector ($90.7 million) and commercial banks ($45.5 million), which was partially offset by reductions in obligations to the Central Bank ($19.3 million) and public corporations ($17.8 million).

In terms of currency composition, 56.3 percent of the public sector debt stock was denominated in Bahamian dollars, 38.5 percent in U.S. dollars, and 5.2 percent in other foreign currencies. Regarding interest rate exposure, fixed-rate instruments accounted for 66.0 percent of the portfolio, and variable- rate debt the remaining 34.0 percent.

The Government remains committed to transparency and accountability in debt management activities and invites stakeholders to visit the national Budget Website (www.bahamasbudget.gov.bs) to view the various published reports.

Source: Ministry of Finance, The Bahamas

Date: February 182026

Contact: Financemail@bahamas.gov.bs

In FY2025/26, revenue collections and expenditure growth yielded significant improvement in the government’s fiscal consolidation performance thus far.

Tax revenue grew by $101.6 million (16.5 percent) to $3,439.2 million, for 20.9 percent ofthe budget. Improved economic conditions, alongside strengthened tax administration

measures, supported increases in Taxes on International Trade and Transactions (8.3 percentto $202.7 million), Value Added Tax collections (20.6 percent to $409.4), and Taxes on Use and Permission to Use Goods (20.5 percent to $34.1 million).

Non-tax revenue expanded by $5.7 million (8.6 percent) to $71.8 million and was largely

attributed to higher receipts from the sale of goods and services ($9.2 million).

Aggregate expenditure increased by $70.6 million (8.2 percent) to $930.7 million (24.4

percent of the budget), with the recurrent and capital components at $803.8 million and

$127.0 million, respectively. Key drivers behind the $ 64.6 million gain in recurrent

expenditure included outlays for use of goods and services ($17.9 million) compensation of employees ($8.9 million) and other payments (28.2 million). Capital expenditure increased by $6.0 million (5.0 percent) to $127 million or 33.7 percent of the budget. This outcome stemmed from increases in the acquisition of non-financial assets of $7.5 million (7.4 percent) to $109.0million.

As a result of these developments, the fiscal deficit narrowed by $36.6 million (20.6 percent), to $141.1 million and converged to an estimated 0.9 percent of GDP.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: 4 February 2026

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal

operations for the month of October 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $295.4 million, a 15.3 percent increase from the prior year, with the tax component rising by $35.2 million to $271.2 million. Key gains were registered for value-added tax collections ($15.2 million) and taxes on international trade and transactions ($12.4 million). Non-tax revenue edged higher by $4.2 million to $24.2 million, on account of customs fees and rental receipts.

Aggregate expenditure settled at $315.2 million, with the recurrent and capital components at $293.6 million and $21.6 million, respectively. The year-over-year $30.7 million reduction was largely associated with lower outlays for the use of goods and services ($20.8 million) and other transfer payments ($8.2 million).

As a result of the above movements, the Government’s overall fiscal position for October 2025 recorded an estimated deficit of $19.8 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $157.0 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: February 4, 2026

Contact: Financemail@bahamas.gov.bs

In fulfillment of reporting requirements under the Public Debt Management Act, 2021, the Ministry of Finance is pleased to release the FY2026/27 to FY2028/29 Medium-term Debt Management Strategy (the “MTDS”). The MTDS aims to guide the government’s borrowing decisions to fund its overall financing needs, at the lowest cost consistent with a reasonable degree of risk, while promoting the development of the domestic debt market.

In determining the optimal debt management strategy, the analysis considers the costs and risks of the existing debt portfolio, the government’s medium-term financing needs and macro-fiscal policy objectives, prevailing economic and market conditions, and other relevant factors.

Four financing options were assessed and evaluated based on their cost-risk profiles and

performance subjected to various stress scenarios. The selected strategy emphasizes greater reliance on domestic sources of financing to reduce foreign currency exposure and support the development of the domestic capital market. Other key features of the strategy include a higher share of fixed-rate instruments, the continued use of semi-concessional borrowing from multilateral institutions, and the implementation of liability management operations to mitigate refinancing risk, extend the average time to maturity of the debt portfolio, and manage interest rate risk, while balancing costs. The financing mix suggests gross external and domestic borrowings in the ratio of 22 percent and 78 percent, respectively.

For a copy of the MTDS and other fiscal and debt reports, the public is invited to visit the national Budget Website (www.bahamasbudget.gov.bs).

PRESS RELEASE

Government Revenue Rises to $218.3M in September 2025

Source: Ministry of Finance, The Bahamas

Date: December 17 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal

operations for the month of September 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, total revenue reached $218.3 million, an increase of $30.6 million (16.3 percent) compared to the prior year. Tax receipts at $199.0 million, featured Value Added Tax collections of $110.3 million, which grew by $25.0 million due to strengthened compliance, alongside a $11.7 million increase in VAT on realty-related transactions. Additional gains were recorded in taxes on international trade and transactions ($57.9 million) and taxes on specific services ($3.9 million), the latter representing gaming tax receipts. Non-tax revenue totaled $19.3 million, led by an $18.6 million collection from sales of goods and services. Total expenditure for September 2025 amounted to $280.2 million, comprising $249.4 million in recurrent expenditure and $30.8 million in capital outlays. The $38.7 million (18.4 percent) year- over-year growth in recurrent expenditure included higher payments of employee insurance premiums, and increased subsidies to several public institutions. Capital expenditure declined by $7.1 million (18.8 percent), of which 83.0 percent was allocated for the acquisition of non-financial assets and with the balance representing capital transfers.

As a result of these developments, the Government recorded an estimated fiscal deficit of $61.9 million for September 2025, compared with $61.0 million in the corresponding period last year. Central Government debt increased by $60.5 million, with domestic borrowings of $177.4 million partially offset by $111.8 million in repayments.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

PRESS RELEASE

Government Revenue Rises to $244.2 million

Source: Ministry of Finance, The Bahamas

Date: December 17, 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of August 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $244.2 million, a 12 percent increase from theprior year, with the tax component rising by $28.3 million to $221.8 million. Key gains wereregistered for value-added tax collections ($26.4 million) and taxes on use and permission to use goods ($6.3 million). Additionally, non-tax revenue yielded $22.4 million.

Expenditure aggregated to $254.5 million, comprising recurrent and capital spending of $214.7 and 39.7 million, respectively. The $24.7 million overall decline in expenditure, was primarily due to lower payments for services, and supplies and materials ($9.2 million). Other payments also fell to $16 million, due to the timing of insurance premium payments.

Capital expenditure decreased by $7.5 million (15.9 percent), with the bulk expended for the acquisition of non-financial assets (71.0 percent) and the remainder representing capital transfers.

Based on the outcomes, the Government’s overall fiscal position for August 2025 recorded an estimated deficit of $10.2 million which was substantially below the $61.1 million in the corresponding period. Financing activities for the month featured an estimated increase in the outstanding debt stock of $28.5 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Central Communications Unit, Ministry of Finance, The Bahamas

Date: November 20, 2025

Contact: MOFcomms@bahamas.gov.bs

In keeping with Section 61 of the Public Debt Management Act, 2021, the September 2025 Public Debt Statistical Bulletin (“PDSB”) represents the seventeenth official report on public debt statistics in The Bahamas prepared by the Debt Management Office (the “DMO”) of the Ministry of Finance.

At end-September 2025, the public sector debt stock was estimated at $13,550.6 million—representing respective gains of $307.9 million (2.3%) and $480.7 million (3.7%) vis-à-vis end-June 2025 and endSeptember of the prior year. Quarterly net financing activities boosted the central Government’s component by $300.3 million (2.6%) to $12,069.5 million, for an estimated 73.4% of GDP. Meanwhile, debt of the Agencies and Government Business Enterprises increased slightly by $7.6 million (0.5%) to $1,481.1 million.

Since end-June 2025, public sector external debt declined by $43.4 million (0.8%) to $5,505.2 million, which corresponded to a 1.3 percentage point reduction in share to 40.6%. Approximately $26.0 million (59.9%) of this decline was associated with reduced claims on financial institutions, with the balance ($17.4 million) spread across multilaterals (21.4%), private capital market (12.2%) and bilateral (6.5%) creditors.

Quarterly growth in the domestic currency component of public debt amounted to $351.2 million (4.6%), for an outstanding balance of $8,045.4 million at end-September 2025. The expansion was primarily explained by the central government’s $302.1 million (42.6%) increased liabilities to the Central Bank. Public sector debt obligations to the private sector and the central Government were also higher by $59.7 million (2.0%) and $27.7 million (6.4%), respectively. These were partly offset by a $37.2 million reduction in debt owed to commercial banks and a lesser $1.1 million for public corporations.

By currency, 56.9% of the public sector debt portfolio was in Bahamian Dollars, 37.7% in USD, and 5.4% held in other foreign currencies. Fixed rate debt constituted an elevated 66.2% of the overall portfolio, with the variable rate share at 33.8%.

The Government remains committed to transparency and accountability in debt management activities and invites stakeholders to visit the national Budget Website (www.bahamasbudget.gov.bs) to view the various published reports.

Source: Ministry of Finance, The Bahamas

Date: 24 October 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of July 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $326.7 million, an 18.0 percent increase from the prior year, with the tax component rising by $41.5 million to $296.8 million. Key gains were registered for taxes on international trade and transactions ($24.2 million) and value-added tax collections ($18.6 million). Non-tax revenue edged higher by $8.2 million to $29.9 million, on account of improved collection of customs and immigration fees.

Aggregate expenditure settled at $392.6 million, with the recurrent and capital components at $337.3 million and $55.3 million, respectively. The year-over-year $60.2 million gain was largely associated with higher outlays for the use of goods and services ($22.7 million), other transfer payments ($27.1 million), and acquisition of capital assets ($14.9 million).

As a result of the above movements, the Government’s overall fiscal position for July 2025 recorded an estimated deficit of $65.9 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $224.3 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: 24 October 2025

Contact: Financemail@bahamas.gov.bs

In FY2024/25, the combination of solid gains in revenue collections and prudent expenditure growth yielded significant improvement in the government’s fiscal consolidation performance.

Tax revenue grew by $290.3 million (10.6 percent) to $3,026.4 million, for 96.3 percent of the budget. Improved economic conditions, alongside strengthened tax administration measures, supported increases in Taxes on International Trade and Transactions (20.2 percent to $871.7 million), Value Added Tax collections (6.8 percent to $1,438.0), and Taxes on Use and Permission to Use Goods (14.5 percent to $322.1 million).

Non-tax revenue expanded by $36.2 million (10.9 percent) to $369.2 million and was largely attributed to higher receipts from the sale of goods and services ($27.4 million).

Aggregate expenditure increased by $211.8 million (6.5 percent) to $3,474.9 million (96.2 percent of the budget), with the recurrent and capital components at $3,189.3 million and $285.6 million, respectively. Key drivers behind the $ 227.8 million gain in recurrent expenditure included outlays for use of goods and services ($130.1 million) compensation of employees ($35.1 million) and public debt interest ($59.2 million). Capital expenditure decreased by $16.1 million (5.3 percent) to $285.6 million or 82.9 percent of the targeted spend. This decline was due to lower outlays for the acquisition of non-financial assets of ($6.8 million) and capital transfers ($9.2 million).

As a result of these developments, the fiscal deficit narrowed by $115.1 million (59.3 percent), to $78.9 million and converged to an estimated 0.5 percent of GDP—which was in line with the budget target.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports

The Commonwealth of the Bahamas (“Bahamas”), rated B1 by Moody’s, BB- by S&P and BB- by Fitch, requested Deutsche Bank to arrange a non-deal Fixed Income Investor Call on Wednesday October 8th at 11:00am ET / 16:00pm UKT.

The call will feature the Minister of Economic Affairs – the Honorable Michael Halkitis – and the Financial Secretary – Simon Wilson – who will provide an update on The Bahamas credit as well as recent developments such as the upgrade received by S&P to BB-, followed by Q&A.

An accompanying presentation during the live webinar will be available.

Please use the following link to pre-register.

Webinar link: https://evercall.co/oacc/12380

This message is for informational purposes only. This message is not an offer to sell, purchase or a solicitation of an offer to sell or purchase any securities. This message is not a recommendation or investment advice.

Source: Ministry of Finance, The Bahamas

Date: 26 September, 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release the Monthly Fiscal Report for June 2025, as mandated by the Public Finance Management Act, 2023.

Preliminary data for the month indicate a significant turnaround in the Government’s fiscal position, to an overall surplus of $25.4 million from a deficit of $35.8 million in June 2024. This positive outcome featured a $74.4 million (31.6 percent) year-over-year increase in total revenue to $310.0 million, which more than offset a modest $13.2 million (4.9 percent) rise in total expenditure to $284.6 million.

Within revenue, tax receipts expanded by $58.8 million (28.7 percent) to $263.3 million, supported by stronger inflows from international trade and transactions which advanced by $29.9 million to $99.5 million, following enhanced enforcement of export duties. Value added tax receipts rose by $13.8 million to $113.0 million, reflecting yield gains across realty transactions, customs, and other goods and services. Taxes on the use of goods and permissions to use goods also increased by $8.3 million to $24.3 million, owing to higher receipts of communication levies. Growth in non-tax revenue of $16.2 million (52.9 percent) to $46.7 million was mainly attributed to boosted dividend income.

On the expenditure side, recurrent spending for the review month was $268.7 million, a year-over-year gain of $22.4 million (9.1 percent). This was largely associated with elevated outlays for the use of goods and services by $27.3 million to $61.8 million, partly due to timing differences in payments for communication expenses. Personal emoluments increased by $14.1 million to $89.1 million, mainly reflecting payments for allowances and NIB contributions, while public debt interest payments were higher by $18.6 million at $74.5 million, consistent with growth in the Government’s overall liabilities. In contrast, capital expenditure contracted by $9.1 million (36.3 percent) to $15.9 million, owing to moderated outlays for transfers and acquisition of non-financial assets.

For fiscal year 2024/25, the deficit stands at an estimated 0.5 percent of GDP, which remains firmly within the targeted range of 0.3 to 0.7 percent of GDP.

As a result of financing activities, central Government’s outstanding debt decreased by an estimated $360.9 million in June 2025. Proceeds from borrowings totaled $1,745.8 million, of which 80.6 percent was sourced in foreign currency and elevated by the recent international bond issuance and commercial borrowing. Debt repayments amounted to $2,106.7 million, with the 70.6 percent in foreign currency obligations inclusive of $767.4 million in Eurobond repurchases.

The Ministry of Finance is committed to the Government’s mandate of full transparency and timely reporting. The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: 21 August 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of May 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $268.2 million, a 4.3 percent decrease from the prior year, with tax revenue higher by $3.4 million at $237.9 million. The performance featured gains of $18.7 million in value-added tax collections to $119.2 million and $4.4 million in taxes on financial & capital transactions to $11.5 million. Taxes on Property saw a decline of 11.4 million placing it at 10.5 million. Non-tax revenue declined by $15.6 million to $30.3 million, driven by timing differences of payment receipts.

Aggregate expenditure settled at $238.8 million, with the recurrent and capital components at $225.7 million and $13.1 million, respectively. The year-over-year $22.9 million decline was due to lower outlays for subsidies ($8.7 million) and Other Payments ($9.0 million). Capital expenditure declined by $5.6 million to $13.1 million.

As a result of the above outcomes, the Government’s overall fiscal position for May 2025 posted an estimated surplus of $29.4 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $72.3 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Central Communications Unit, Ministry of Finance, The Bahamas

Date: 19 August 2025

Contact: MOFcomms@bahamas.gov.bs

In keeping with Section 61 of the Public Debt Management Act, 2021, the June 2025 Public Debt Statistical Bulletin (“PDSB”) represents the sixteenth official report on public debt statistics in The Bahamas prepared by the Debt Management Office (the “DMO”) of the Ministry of Finance.

At end-June 2025, the public sector debt stock was estimated at $13,149.3 million—representing respective gains of $17.4 million (0.1%) and $440.9 million (3.5%) vis-à-vis end-March 2025 and June of the prior year. Net financing activities broadened the central Government’s component by $455.4 million (4.0%) year-on-year, to $11,769.2 million, which represented an estimated 73.4% of GDP compared with 77.7% at end-June 2024

Foreign currency debt rose by $157.7 million (2.8%), on an annual basis, to $5,883.0 million, with its corresponding share in the total moderating by 31 basis points to 44.7%. Reflecting new domestic securities issuances, Bahamian Dollar debt expanded by $283.2 million (4.1%) to $7,266.3 million (55.3% of the total).

Growth in external public sector debt was mainly explained by the $273.0 million (23.5%) increase in net exposure to financial institutions, following on the central Government’s drawdown of several new credit facilities. The government’s two capital market transactions netted a $59.9 million (2.1%) expansion in debt owed to private capital markets. These outcomes were significantly moderated by the $125.4 million net repayment to multilateral institutions, with a lesser $5.3 million reduction for the bilateral creditor.

Public sector domestic debt operations registered an annual gain of $238.6 million (3.2%), mainly due to higher liabilities to commercial banks and the private sector, of $224.6 million (8.0%) and $207.6 million (7.7%), respectively. In a strong offset, debt owed to the Central Bank and public corporations was reduced by $166.1 million (19.0%) and $99.2 million (14.3%), respectively.

By currency, 55.3% of the debt portfolio was in Bahamian Dollars, 39.0% in USD, and 5.7% held in other foreign currencies. Fixed rate debt constituted an elevated 64.7% of the overall portfolio, with the variable rate share at 35.3%

The Government remains committed to transparency and accountability in debt management activities, and invites stakeholders to visit the national Budget Website (www.bahamasbudget.gov.bs) to view the various published reports.

Source: Ministry of Finance, The Bahamas

Date: 23 July 2025

Contact: Financemail@bahamas.gov.bs

The fiscal performance for the third quarter of FY2024/25 featured strong year-over-year improvements in revenue collections, supported by recent policy-based changes alongside enhanced administrative and enforcement measures.

Tax revenue improved by $243.2 million (12.4 percent) to $2,199.3 million – although positioning at 70 percent of the budget. Increased gains in international trade and transactions were boosted by recent changes in departure tax rates ($502.3 million to $627.3 million). Gains were also registered for Value Added Tax collections ($993.9 million to $1,044.7 million), and taxes on use and permission to use goods ($173.4 million to $223.8 million).

Growth in non-tax revenue of $22.8 million (9.7 percent) to $258.2 million, reflected collections of bank surplus fees, property income and the sales of goods and services.

Expenditure increased by $230.8 million (9.6 percent) to $2,636.7 million (73 percent of the budget), with the recurrent and capital components at $2,370.8 million and $266.0 million, respectively. Key drivers of recurrent expenditure included compensation of employees ($649.0 million), use of goods and services ($514.2 million), public debt interest ($447.3 million), and subsidies ($338.0 million). Capital expenditure included gains in capital transfers of $14.7 million, to $55.4 million and outlays for the acquisition of non-financial assets increased by $16.1 million to $210.6 million.

As a result of these developments, the overall deficit narrowed by $35.5 million (16.6 percent), to $178.9 million, from the comparative period in the prior year.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: 23 July 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of April 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $347.4 million, a 3.9 percent decrease from the prior year, with the tax component declining by $15.2 million to $325.8 million. This outcome was primarily driven by timing difference in the receipt of business license fees compared to the prior year. Key gains were registered for value-added tax collections ($8.6 million) and gaming tax receipts ($6.5 million). Non-tax revenue edged higher by $0.9 million to $21.5 million, almost entirely derived from the sale of goods and services ($21.0 million).

Aggregate expenditure settled at $349.5 million, with the recurrent and capital components at $330.0 million and $19.6 million, respectively. The year-over-year $25.4 million gain was largely associated with higher outlays for the use of goods and services ($20.0 million), transfers ($7.5 million), and subsidies ($7.3 million). Capital expenditure declined by $3.1 million, due to lower spending on transfers and acquisition of non-financial assets.

As a result of the above movements, the Government’s overall fiscal position for April 2025 recorded an estimated deficit of $2.1 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $6.7 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: July 09, 2025

Contact: Financemail@bahamas.gov.bs

Section 13 of the Public Debt Management Act, 2021 mandates that the Minister of Finance ensure the publication of the government’s annual borrowing plan (ABP)—outlining the government’s projected borrowing needs, as contained in the approved annual budget, and including the categories and nominal amounts of debt instruments to be issued.

In compliance with these statutory requirements, and aligned with the broader debt management objectives, the FY2025/26 ABP aims to meet the government’s borrowing needs at the lowest possible cost, while effectively managing risk. According to the approved FY2025/26 budget, the government estimates gross financing needs (GFN) of $1,116.0 million—comprising $1,191.5 million designated for refinancing maturing debt securities and loans, and offset by the $75.5 million budget surplus.

The overall borrowing plan focuses on extending the average maturity of the debt to reduce liquidity and refinancing risk, while balancing cost and risk in the debt portfolio. The approach includes refinancing maturing Bahamian dollar-denominated securities through new issuances, accessing semi-concessional loans from multilateral lenders, and exploring liability management initiatives, where feasible.

Against the backdrop of prevailing global and domestic financial conditions, the government plans to raise approximately $579.4 million (51.9 percent) of the GFN in Bahamian Dollars, $228.0 million (20.4 percent) domestically in foreign currency representing a rollover of the promissory note arrangement with the Central Bank of The Bahamas for the FY2022/23 SDR borrowings, and $308.6 million (27.7 percent) in foreign currency from multilateral sources. The latter comprises $265.0 million in new loans from International Financial Institutions (IFIs), alongside an estimated $43.6 million in drawings on existing IFI facilities.

Although the FY2025/26 ABP does not include any international bond issuance, the government intends to proactively monitor market conditions to evaluate potential liability management opportunities.

The government views the ABP as a key component of its commitment to fiscal accountability and promoting transparency and borrowing predictability in debt operations, and invites the public to visit the national Budget Website (www.bahamasbudget.gov.bs) to access the FY2025/26 ABP and other fiscal and debt reports.

NASSAU, Bahamas, June 9, 2025 — The Commonwealth of the Bahamas (the “Government”) announced today the commencement of an offer to purchase for cash (the “Offer”) from each registered holder or beneficial owner (each, a “Holder” and, collectively, the “Holders”) its outstanding series of notes listed in the table below (collectively, the “Notes”) such that the maximum amount to be paid for the outstanding principal amount of each series of Notes validly tendered and accepted for purchase pursuant to the Offer, not including interest accrued and unpaid thereon, is to be determined by the Government in its sole discretion (such amount for each series, the “Maximum Purchase Price”). The terms and conditions of the Offer are set forth in the offer to purchase, dated June 9, 2025 (the “Offer to Purchase”).

Source: Central Communications Unit, Ministry of Finance, The Bahamas

Date: June 5, 2025

Contact: MOFcomms@bahamas.gov.bs

In keeping with Section 61 of the Public Debt Management Act, 2021, the September 2024 public debt statistical bulletin (“PDSB”) represents the fifteenth centralized collection of and dedicated publication on public debt statistics in The Bahamas prepared by the Debt Management Office (the “DMO”) of the Ministry of Finance.

At end-March 2025, the stock of public sector debt was estimated at $13,110.9 million, which corresponded to a quarterly decline of $53.3 million (0.4%) since end-December 2024 and a $402.5 million (3.5%) expansion since end-June 2024. For the nine months to March, the central Government’s component grew by $394.9 million (3.5%) to $11,708.7 million , which equated to an estimated 73.4% of nominal GDP.

By currency composition, foreign currency the Bahamian Dollar component expanded over the nine months to March 2025 by $485.6 million (6.9%) to $7,468.7 million, for 57.0% of the outstanding debt. Over the same period, foreign currency indebtedness posted a decline of $83.1 million (1.5%) to $5,642.2 million, which corresponded to a 2.0 percentage points reduction in share to 43.0%.

Quarterly movements in the creditor profile of public sector debt featured a contraction in external obligations of $91.5 million, with slightly more than half being attributed to a reduction in claims on financial institutions for a reduced 27.5% of the total. External obligations to multilaterals also declined by $36.7 million and to 23.7% of the total. With a marginal $5.3 million drop in exposure, the dominant private capital markets’ share firmed slightly to 48.1%, while the steady run-off in liabilities to the single bilateral creditor left its share unchanged at 0.7%.

Public sector domestic debt operations featured a $83.5 million quarterly boost in indebtedness to commercial banks and a firming in share to 38.7%. Comparatively smaller gains were posted for both liabilities to the central government ($8.1 million) and public corporations ($1.4 million), with corresponding proportions to the total of 4.2% and 8.3%. In significant offsets, debt owing to the Central Bank and the private sector receded by $38.9 million and $15.9 million, for lowered shares of 12.5% and 36.3 %, respectively.

Dissemination of timely, consistent, comprehensive, reliable and internationally comparable public debt statistics represents a key element of the Government’s commitment to promote accountability and transparency in debt management activities.

The Ministry invites domestic and international stakeholders to visit the national Budget Website (www.bahamasbudget.gov.bs) to view the various published reports.

Source: Ministry of Finance, The Bahamas

Date: 2 June 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly fiscal report on Government’s operations for the month of March 2025, as mandated by the Public Finance Management Act, 2023.

Tax revenue, which accounted for 92.0 percent of total receipts, increased by $64.9 million (20.2 percent) to $387.1 million. This growth was led by a $36.3 million (62.6 percent) surge in international trade and transactions taxes, supported by strengthened compliance and enforcement efforts. VAT collections also increased by $14.4 million (12.9 percent) to $126.0 million, amid ongoing improvements in tax administration. Taxes on the use of goods and permissions, inclusive of motor vehicle licenses and business fees, expanded by $13.1 million (16.2 percent) to $93.4 million. Non-tax revenue declined moderately by $2.2 million (6.1 percent) to $33.8 million, although benefitting from a $2.2 million (12.4 percent) increase in collections from administrative fees, particularly for immigration and customs services.

On the expenditure side, spending restraint was evidenced by a reduction in total expenditure of $23.5 million (8.6 percent) to $251.2 million. Recurrent outlays declined by $4.0 million (1.7 percent) to $233.8 million, which included a $7.9 million reduction in subsidy payments and a $2.0 million decrease in personal emoluments. Interest payments on public debt also declined by $1.1 million to $24.0 million, while payments for use of goods & services and social assistance and pension payments were higher by $2.2 million and $2.3 million to $53.9 million and $22.1 million, respectively. Capital expenditure registered a more pronounced decline of $19.6 million (52.8 percent) to $17.5 million, mainly due to lower levels of capital projects and transfers.

As a result of the above, the Government’s fiscal position for March 2025 recorded a sharply improved surplus of $169.6 million, compared with $83.4 million in the prior year. Proceeds from borrowing totaled $365.6 million, while debt repayments amounted to $396.3 million, resulting in an estimated $30.7 million reduction in the central Government’s outstanding debt.

The Ministry of Finance is committed to the Government’s mandate of full transparency and timely reporting. The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: May 29, 2025

Contact: Financemail@bahamas.gov.bs

In accordance with the Public Finance Management Act, 2023, the Ministry of Finance has published the 2025 Fiscal Strategy Report (2025 FSR) on the Ministry’s Budget website.

This report serves as the annual update of the Government’s medium-term fiscal framework, which informs the FY2025/2026 national budget and annual borrowing strategy, grounded in the macroeconomic forecasts, fiscal objectives, and policies outlined therein.

Revenue is forecasted to improve steadily over the medium term, supported by strong economic fundamentals, ongoing tax administration reforms, and the rollout of the Domestic Minimum TopUp Tax. While revenue collections are projected to reach a revised 23.6 percent of GDP in FY2025/2026 or $3.9 billion, they are expected to grow to 25.0 percent over the subsequent three fiscal years. Preliminary data for the first nine months of FY2024/2025 show revenues at $2.5 billion, up $266.3 million over the same period last year.

Expenditure forecasts reflect the Government’s focus on efficiency and sustainability. Recurrent spending for FY2025/2026 is projected at $3.4 billion – a steady 20.8 percent of GDP with a slight increase to 21.0 percent of GDP through FY2028/2029. Investments are targeted towards healthcare, education, and social support. Capital expenditure is forecasted at a stable 2.3 percent of GDP for FY2025/2026 and onwards, with infrastructure priorities including roads, health facilities, airports, and housing, being largely financed through public-private partnerships and semi-concessional external loans.

The Bahamas’ debt-to-GDP ratio is projected to decline from 71.4 percent in FY2024/2025 to 57.5 percent by FY2028/2029, in line with Government’s ongoing debt management strategy.

The release of the 2025 Fiscal Strategy Report reaffirms the Government’s commitment to the fiscal principles of accountability, intergenerational equity, responsibility, stability, transparency, and inclusive growth.

The Ministry invites and encourages the public to visit the national Budget Website (www.bahamasbudget.gov.bs) to view the various statistical reports available to the public.

Revenue Improves $50.4 million over Prior Year

Source: Ministry of Finance, The Bahamas

Date: 16 May 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of February 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $292.9 million, a 20.8 percent improvement from the prior year, with tax revenue higher by $29.8 million at $241.1 million. The performance featured gains of $11.5 million in value-added tax collections to $103.2 million and $16.1 million in taxes on the use and permission to use goods to $45.7 million. Non-tax revenue expanded by $20.7 million to $51.8 million, driven by receipt of dividends and remittances of banking sector fees.

Aggregate expenditure settled at $234.4 million, with the recurrent and capital components at $220.9 million and $13.4 million, respectively. The year-over-year decline was largely associated with the $6.8 million reduction in capital expenditures.

As a result of the above outcomes, the Government’s overall fiscal position for February 2025 posted an estimated surplus of $58.6 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $28.7 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Date: May 9th, 2025

Contact: TERAHNEWBOLD@BAHAMAS.GOV.BS, CLARICETURNQUEST@BAHAMAS.GOV.BS

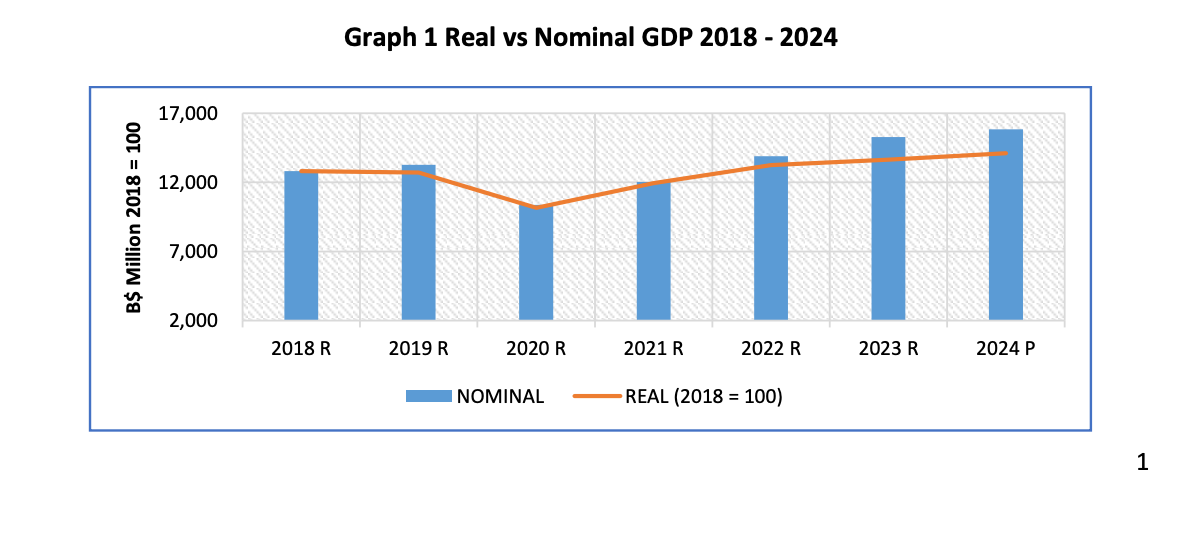

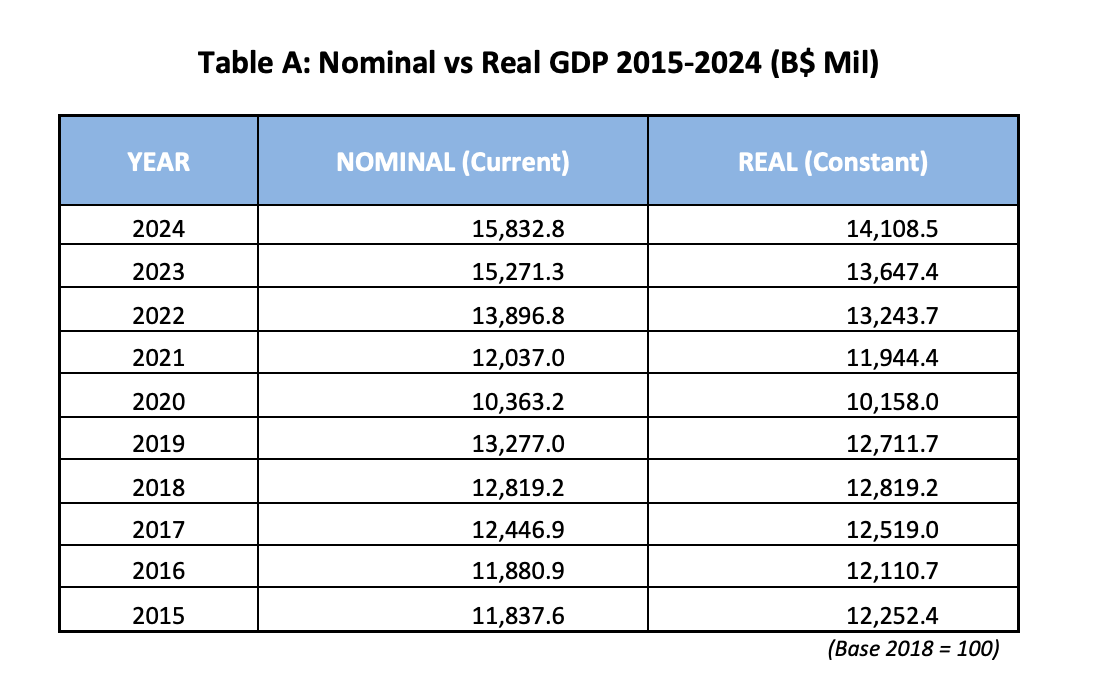

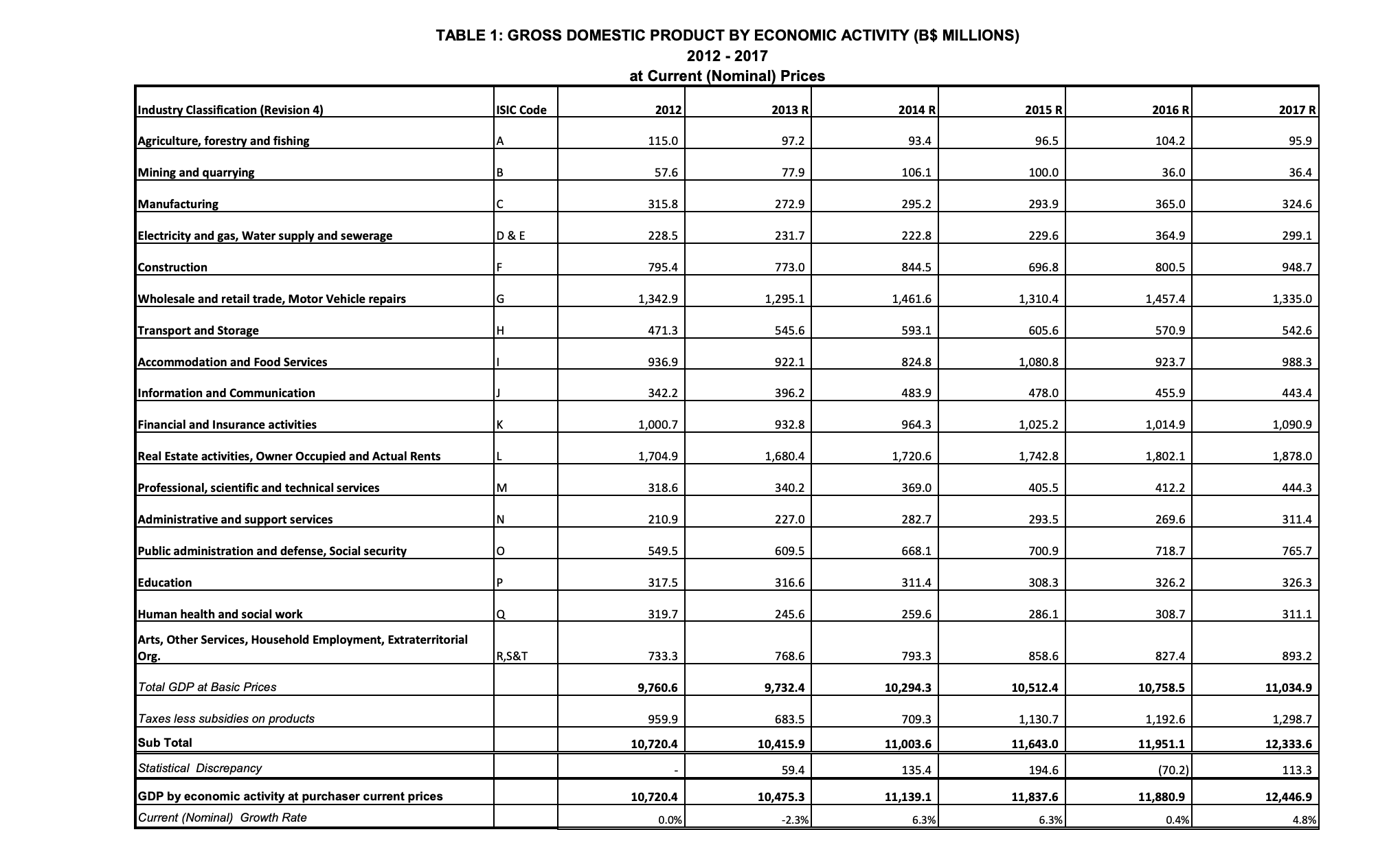

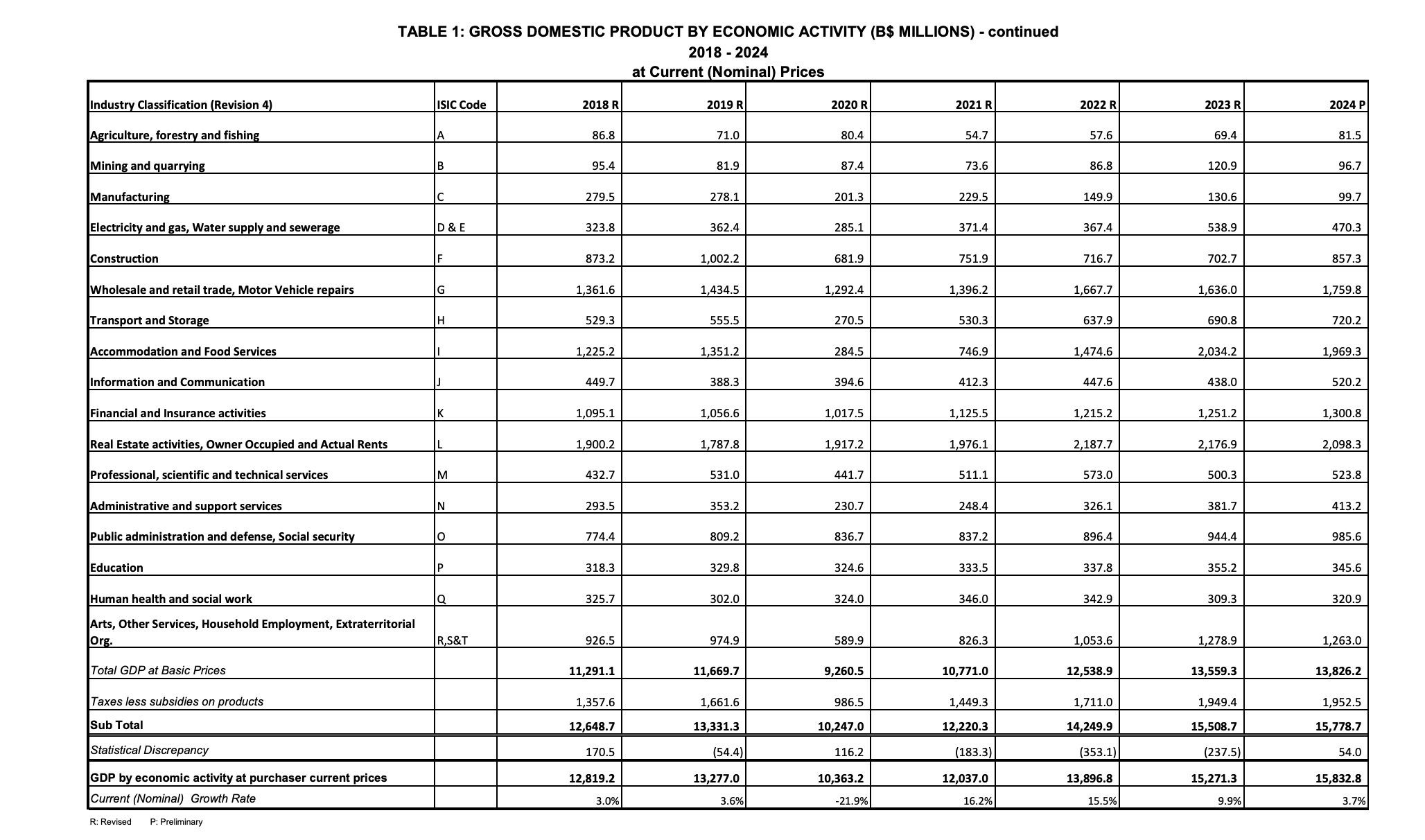

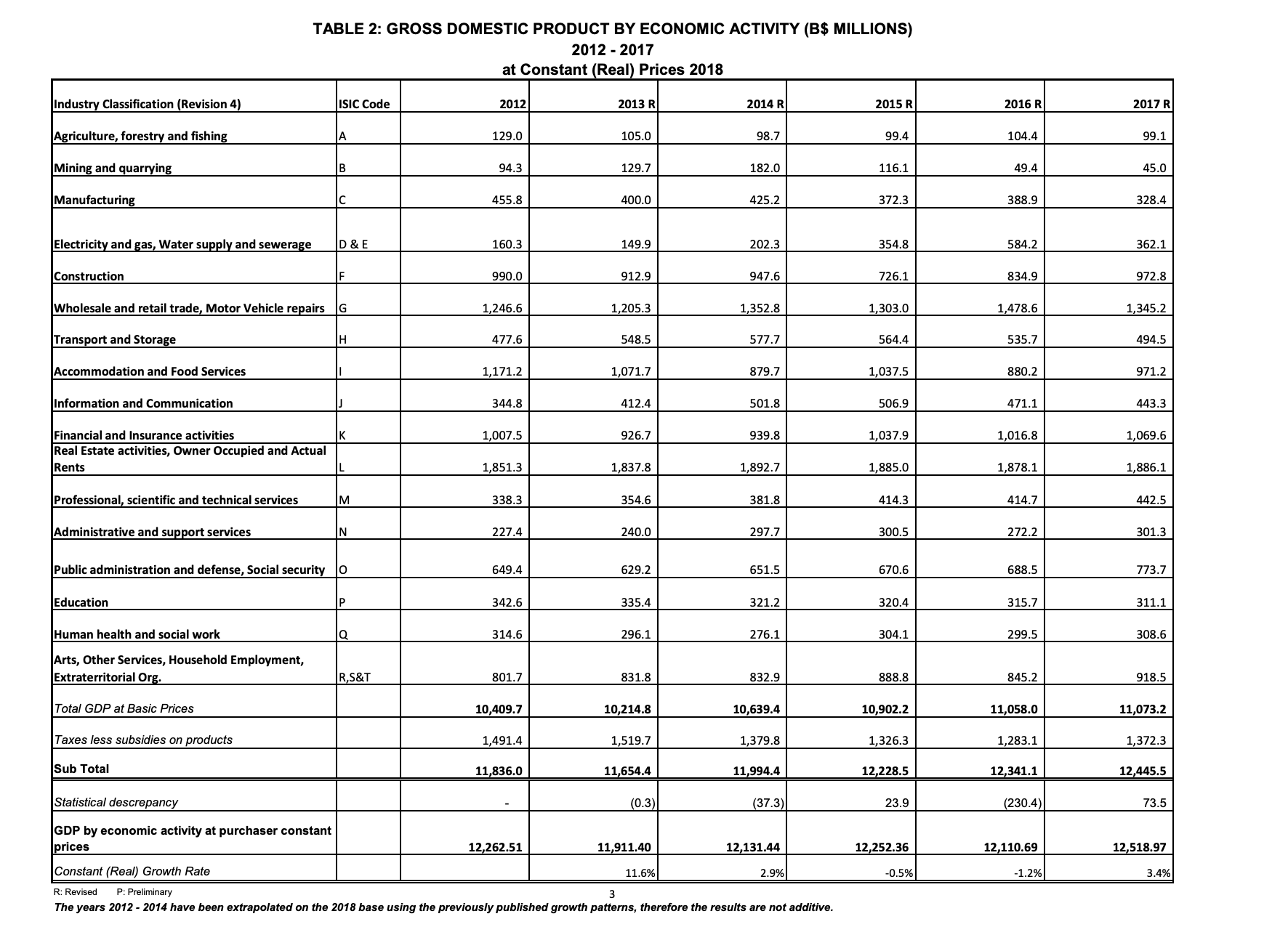

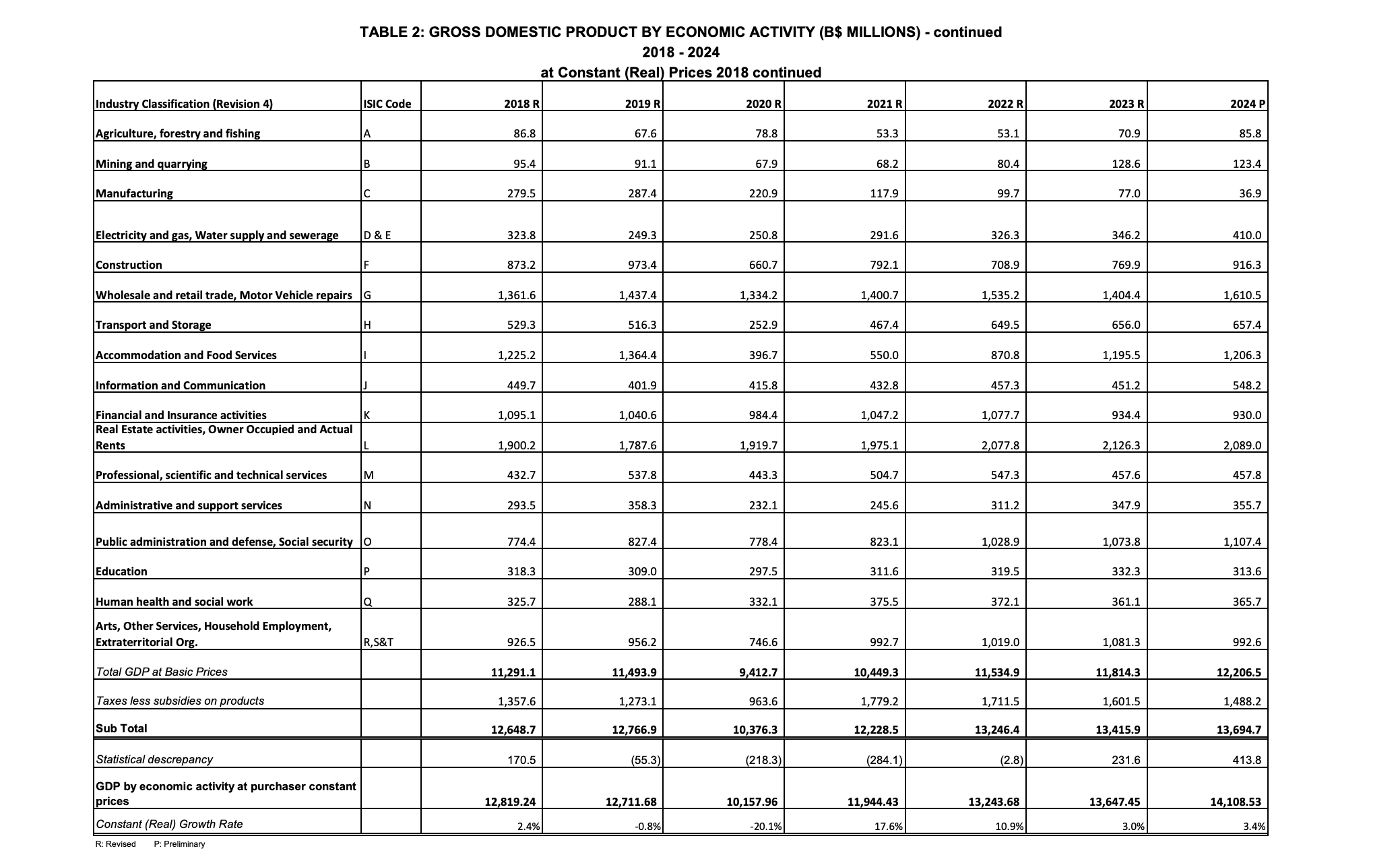

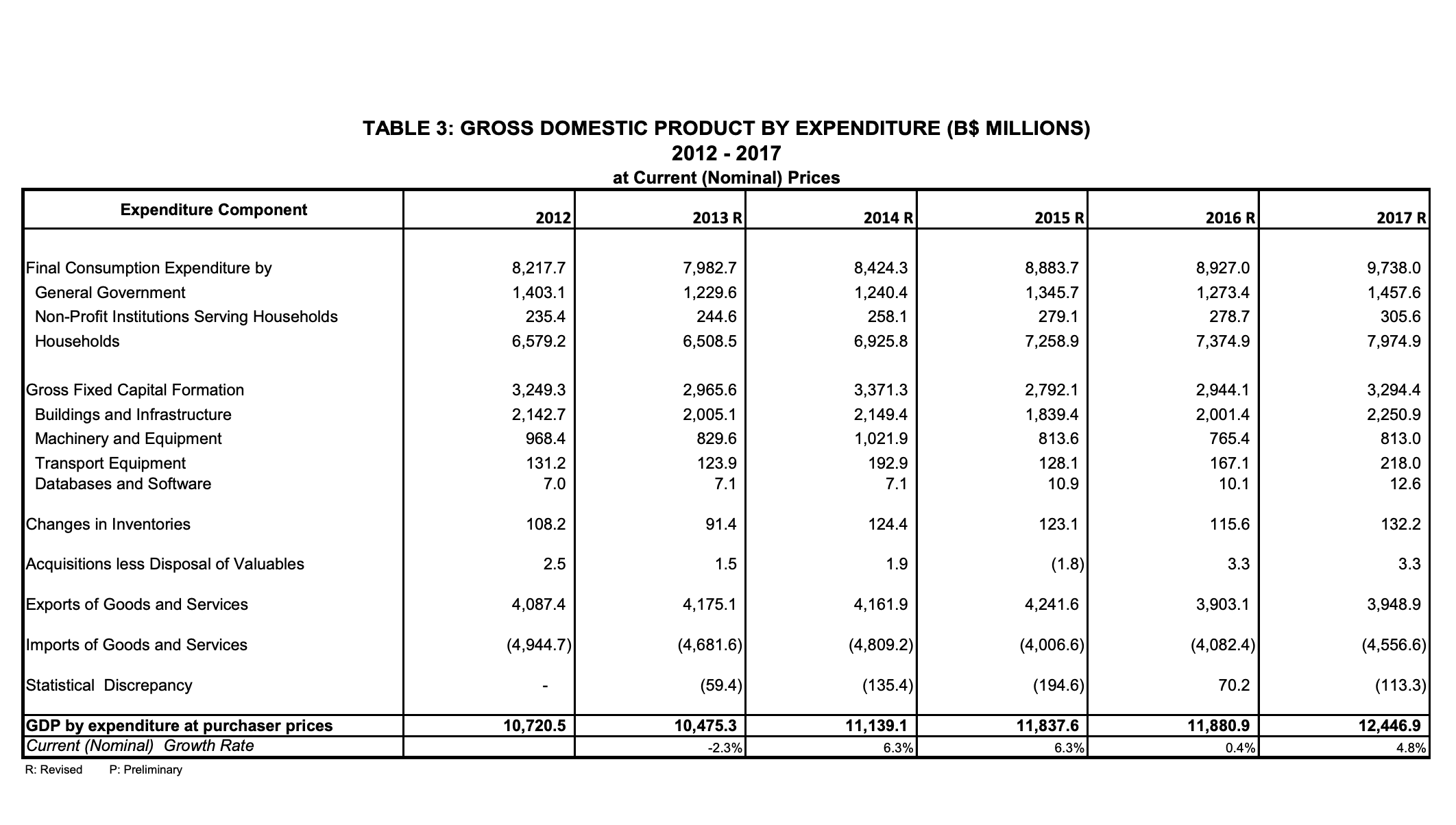

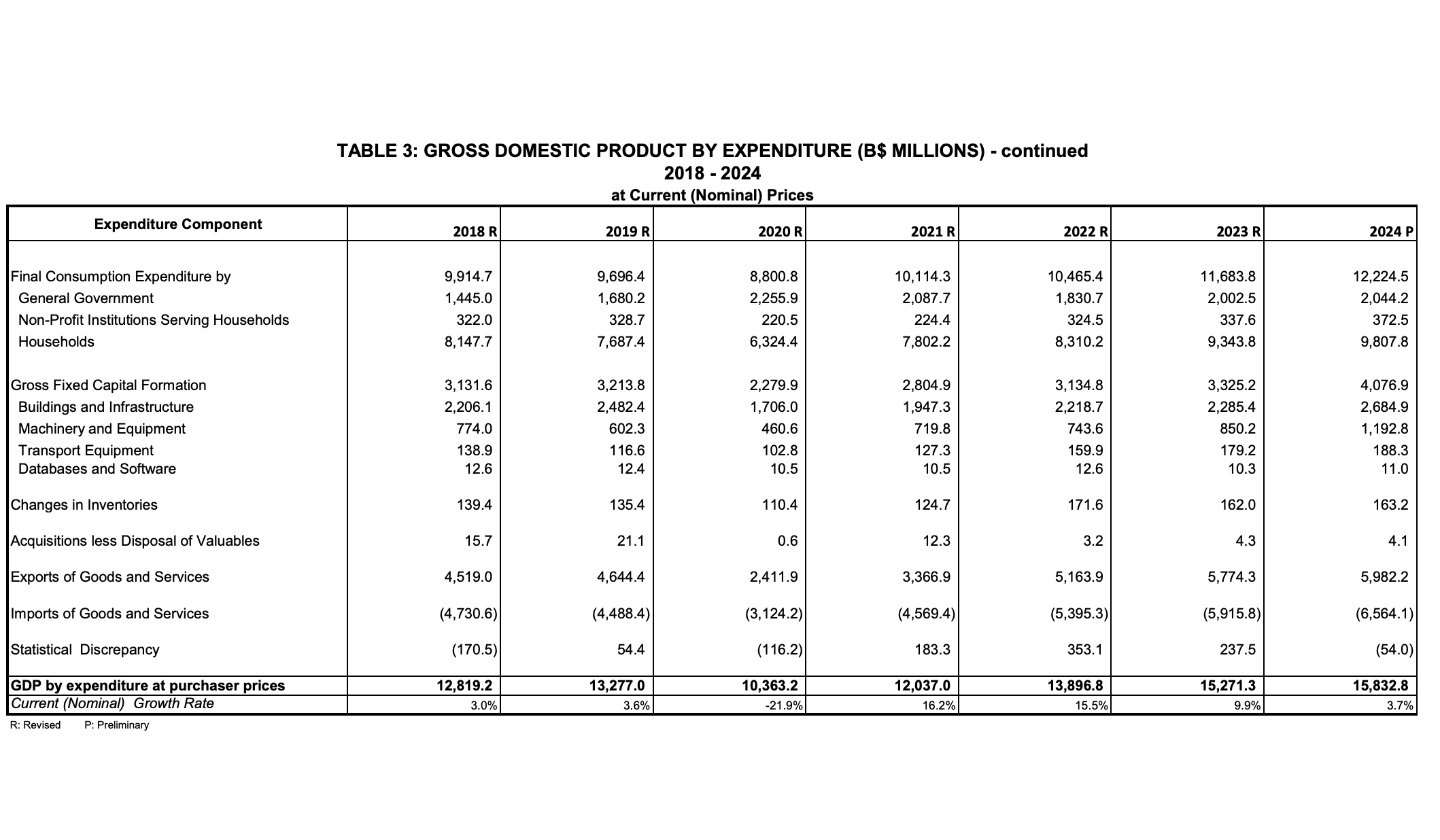

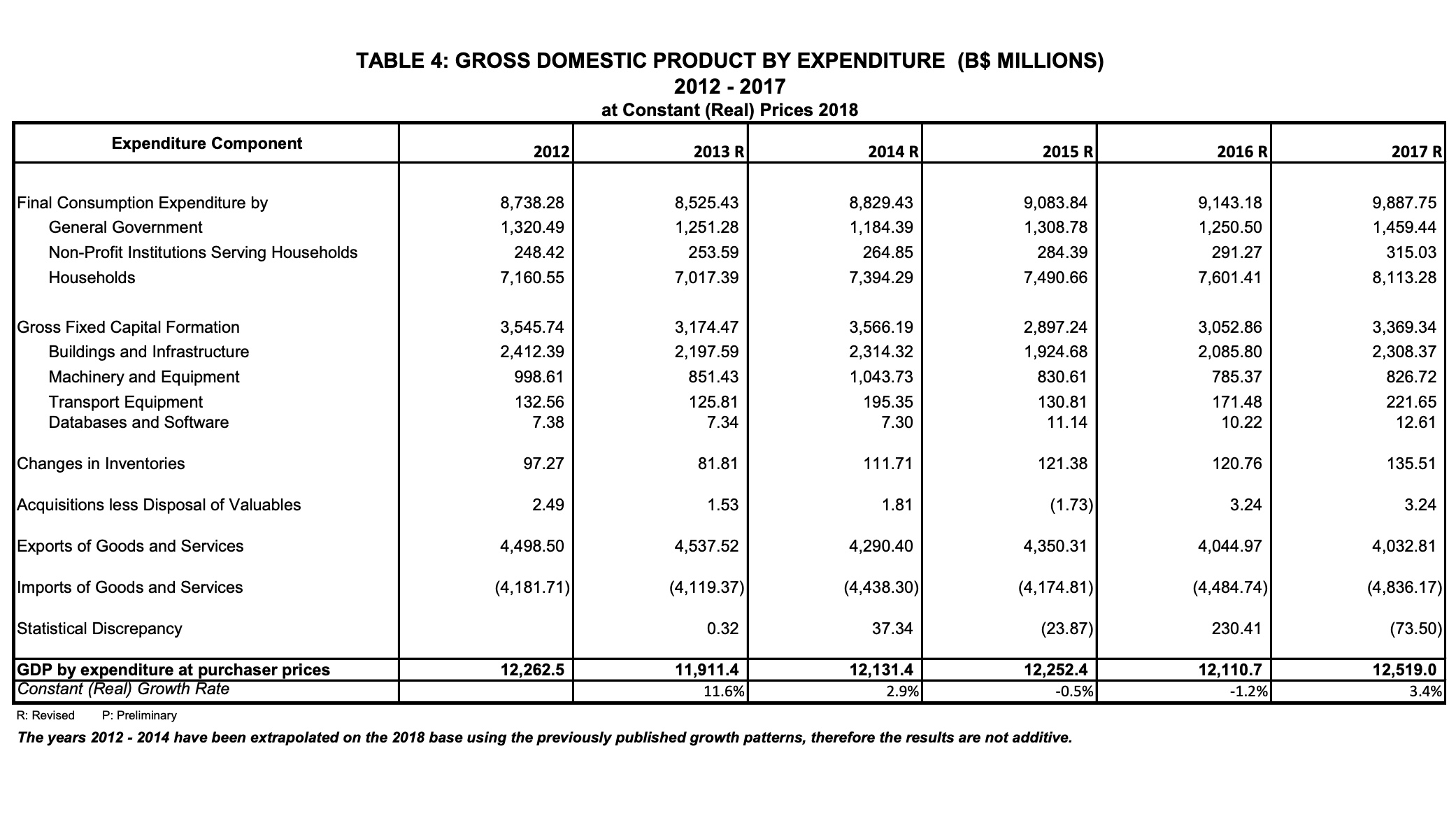

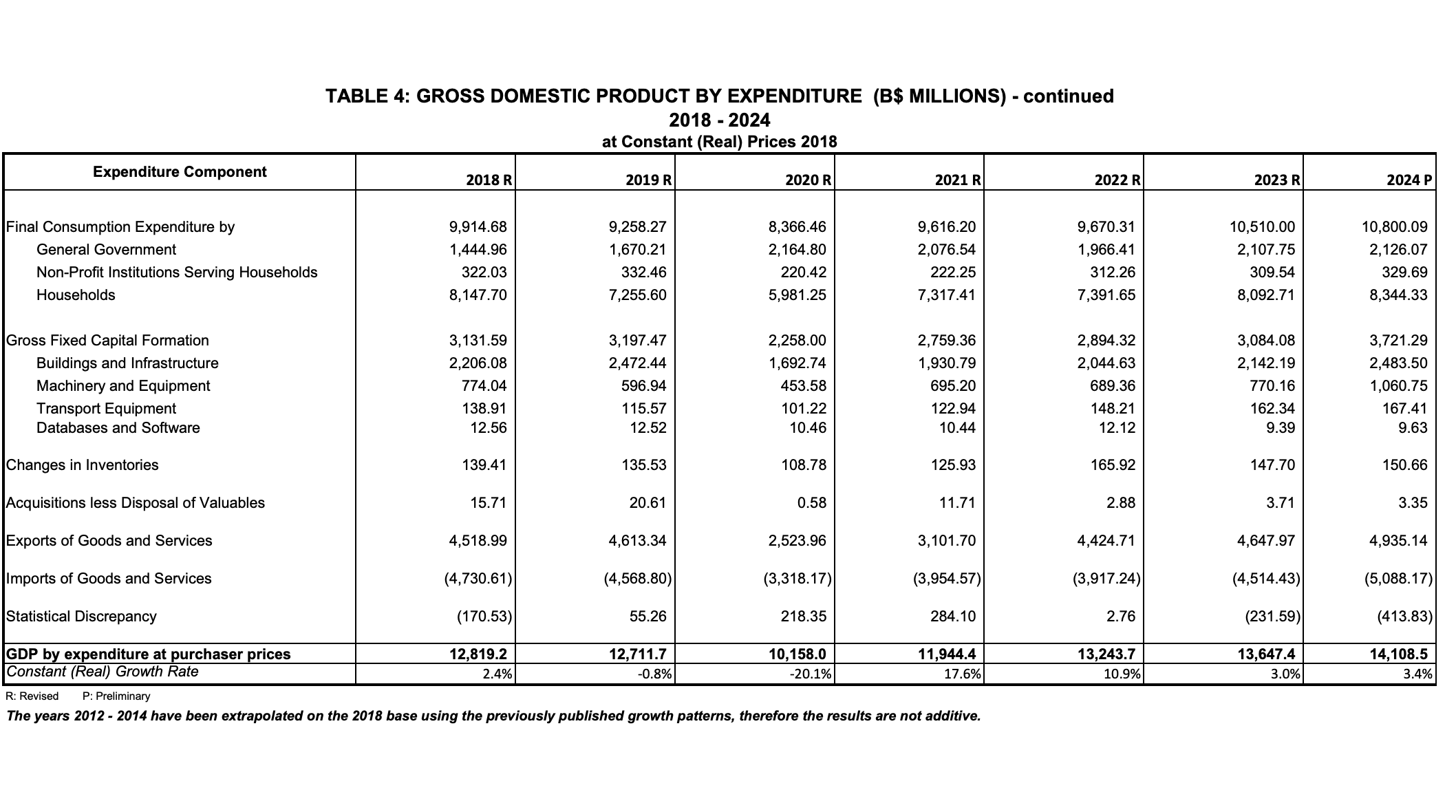

The National Accounts Section of the Bahamas National Statistical Institute (formerly the Department of Statistics) announces the release of the 2024 advance estimates of Gross Domestic Product (GDP). These are compiled by both the Production and Expenditure Approaches and available in nominal (current) and real (constant or inflation adjusted) prices.

According to the 2024 annual estimates, economic activity in the Bahamas increased by 3.7% in nominal terms and by 3.4% in real terms when compared to 2023. This real growth was evident in a number of industries, led by Wholesale and Retail Trade, Motor Vehicle Repair and the Construction Industries, which were responsible for the lion’s share. In 2024, the value added created through the production of goods and services in the Bahamian economy, was estimated at $15.8 billion in nominal prices, and $14.1 billion in real prices.

The Production Approach

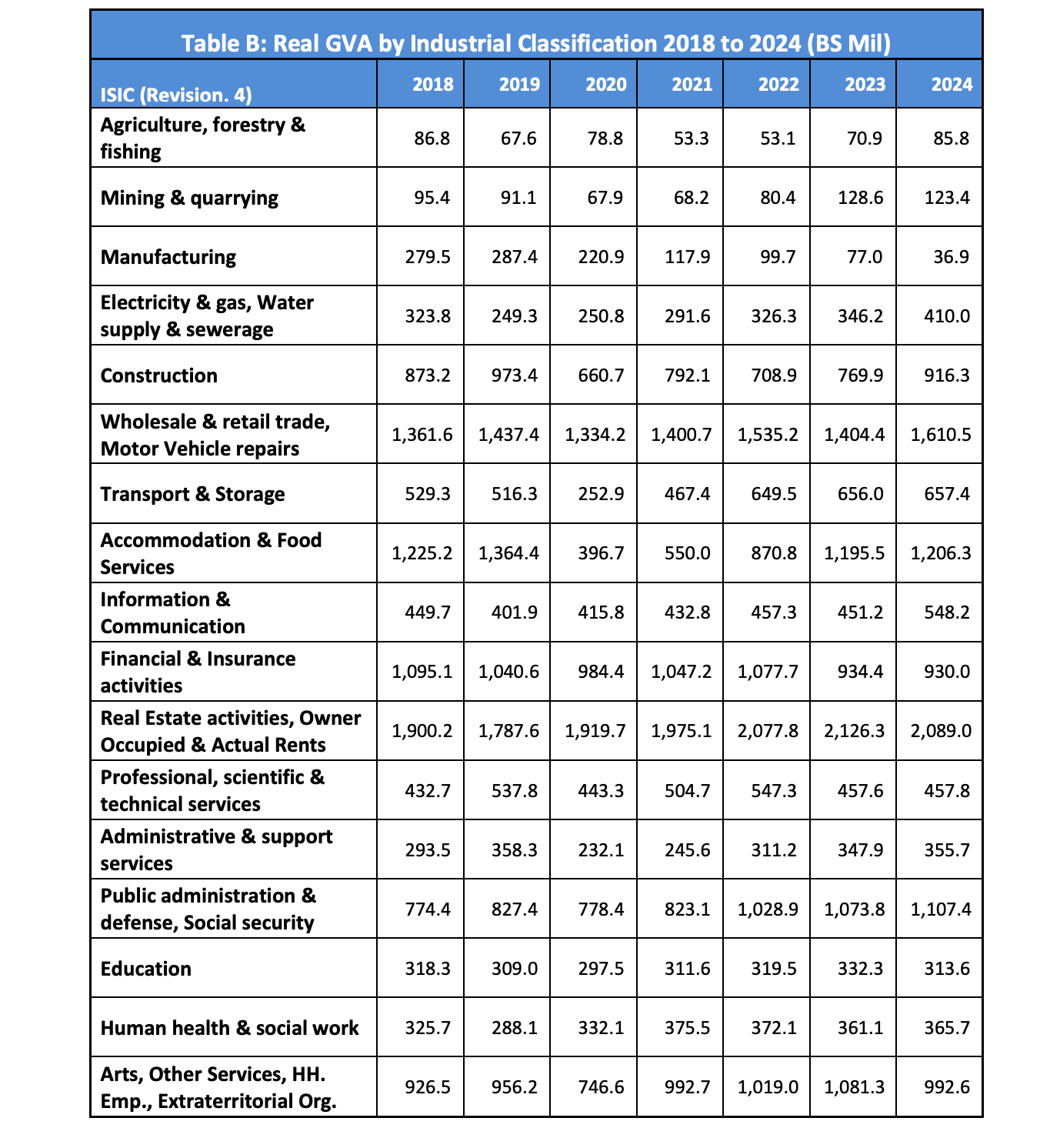

The Production Approach to GDP, which is derived from the Gross Value Added (GVA) by Industry showed an increase in real growth across most industries. The industries indicating the most substantial increases in 2024 were the following:

- Wholesale, Retail Trade and Motor Vehicle repairs – increased by $206 million (15%). This increase is mainly connected to the growth in household consumption.

- Construction – increased by $146 million (19%). This industry increased as capital investment within the country continued to grow as evidenced by a rise in the imports of construction materials.

- Information and Communication – increased by $97 million (21%), as implementation and increased use of digital technology expanded in the Bahamian economy.

- Electricity and gas, Water supply and sewerage – increased approximately $64 million (18%) when compared to 2023. This real growth can be mainly attributed to lower fuel costs in 2024

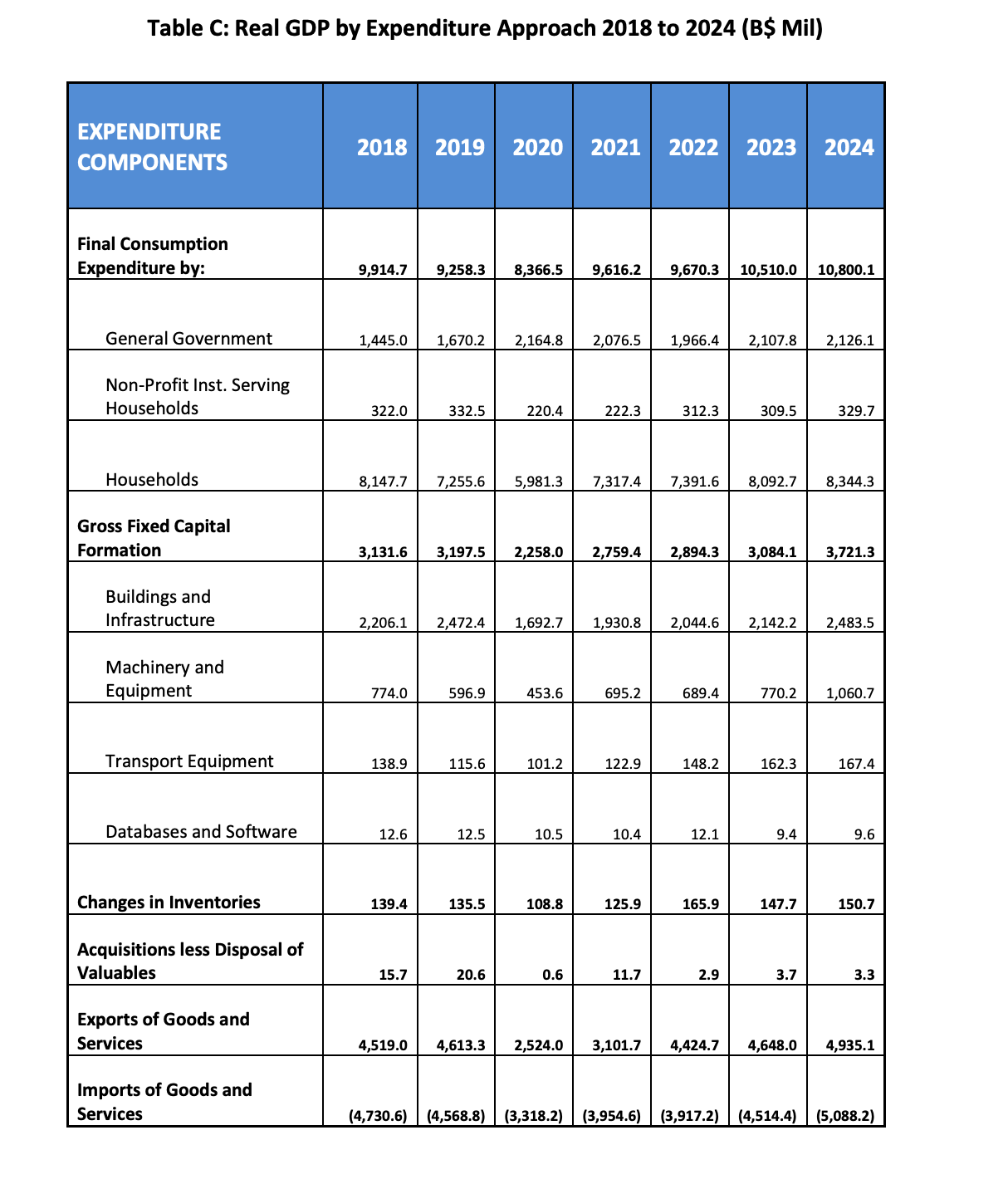

The Expenditure Approach

Gross Domestic Product calculated by the Expenditure Approach (which shows the contribution to the economy of Final Consumption, Investments, Exports and Imports), indicated a real growth in a number of sectors in 2024, primarily reflected in the following components:

- Gross Fixed Capital Formation – showed an increase in 2024 compared to 2023 of 21%. This was led by Building and Infrastructure Sector with an increase of $341 million (16%), followed by Machinery and Transportation Equipment which grew by approximately $291 million (38%).

- Household Final Consumption Expenditure experienced real growth in 2024 of almost $252 million (3%) when compared to 2023.

- Exports of Goods and Services increased by $287 million (6%) in 2024 compared to 2023. This sector includes the contribution to the economy by Tourists which includes both Stopover and Cruise visitors’ spending and represents the majority of this component.

Revisions to Estimates

As is the practice in other countries, the National Accounts is regularly updated to reflect international best practices and recommendations from real sector experts. These revisions which improved both the accuracy and timeliness of GDP estimates, will be explained in greater detail in the National Accounts 2024 Report.

In keeping with the Institute’s Revision Policy, and to maintain the integrity of the GDP data series, the entire series, with the exception of the base year 2012 nominal, have been revised. This allows for an extended, consistent time series, which promotes proper comparability and analysis of economic developments over time. It also allows for incorporation of corrections, new data sources and recommended methodological changes, including the following:

- Balance of Payments updates, provided by the Central Bank of The Bahamas

- Tourism Visitor arrivals and expenditure data updates, provided by the Ministry of Tourism

- External Trade Statistics revisions

- Consumer Price Indices updates

- Aggregated Value Added Tax data updates

- The Business Establishment Survey findings for 2015 – 2023

The full National Accounts 2024 Report is scheduled to be released on the Bahamas Government website under (www.statisticsbahamas.gov.bs) within the next thirty days.

Source: OPM Communications, Office of the Prime Minister, The Bahamas

Date: April 08, 2025

Contact: OPMcommunications@bahamas.gov.bs

Moody’s Ratings (Moody’s) has updated its outlook on the Government of The Bahamas’ rating to positive from stable and has affirmed the long-term issuer and senior unsecured ratings at ‘B1’. The ratings action reflects the agency’s positive view on The Bahamas’ ongoing fiscal consolidation efforts, which are expected to decrease borrowing requirements, support debt reduction and strengthen the country’s credit profile over time.

Regarding recent fiscal performance, Moody’s notes that The Bahamas “fiscal or financial strength, including its debt profile, has materially increased,” as the country “has demonstrated meaningful fiscal consolidation over the past two years, with the primary balance shifting to a surplus of 2.9% of GDP in fiscal 2024, from a deficit of 1.4% of GDP in fiscal 2022.” Positive performance is expected to continue, with the agency forecasting expanding primary surpluses at 4.5% of GDP for Fiscal Year 2025/26, driven by “higher revenue collection and discipline on the expenditure side.” Undergirding this are ongoing tax compliance efforts and additional revenue from the Qualified Domestic Minimum Top-Up Tax (“QDMTT”), which on its own is expected to increase total revenues by approximately 1% of GDP beginning in Fiscal Year 2025/26.

The improved fiscal position is expected to decrease gross financing needs and ease liquidity pressures, supported by proactive refinancing operations on the external market and bolstered by positive domestic market dynamics. On external refinancing operations, Moody’s pointed out that “efforts to improve the maturity profile of government debt – through measures such as conducting buybacks and refinancing maturing debt with longer-term debt – would demonstrate the government’s capacity to tap diverse external financing sources and would support the credit profile.” Domestically, “the banking system, which is the primary source of domestic financing, maintains ample liquidity, and has demonstrated a willingness to refinance maturing debt at relatively low borrowing costs.”

Regarding The Bahamas’ policy framework, Moody’s notes that the country’s “strong institutional framework and a stable political system,” as well as its “strong track record of policy predictability, transparency and sound macroeconomic policy” are supportive of The Bahamas’ credit profile.

Looking ahead, Moody’s suggests that a ratings upgrade could materialize “if the government continues to demonstrate a track record of fiscal consolidation, leading to a sustained reduction in government debt and improvement in debt affordability.” Additional measures, such as the execution of buybacks or refinancing operations on external markets and the continued development of domestic markets, would also support an upgrade

Source: Ministry of Finance, The Bahamas

Date: 1 April 2025

Contact: Financemail@bahamas.gov.bs

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of January 2025, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $302.1 million, a 4.6 percent improvement from the prior year, of which tax revenue rose by $25.8 million at $279.0 million. Key gains were dominated by value-added tax collections totaling $152.4 million, taxes on international trade and transactions of $69.5 million, and taxes on the use and permission to use goods in the amount of $21.1 million. Non-tax revenue collections totaled $22.9 million with $22.0 million obtained from the sale of goods and services.

Aggregate expenditure settled at $305.9 million, with the recurrent and capital components at $291.4 million and $14.4 million, respectively. The year-over-year decline was largely driven by a reduction of $29.3 million in capital expenditures, primarily resulting from the completion of capital projects that were undertaken in the previous year.

As a result of the above movements, the Government’s overall fiscal position for January 2025 resulted in an estimated deficit of $3.8 million. Financing activities for the month featured an estimated decrease in the outstanding debt stock by $28.6 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: 31 March, 2025

Contact: Financemail@bahamas.gov.bs

Preliminary data on the first half of FY2024/2025 featured an improved revenue performance, aided by enhanced administrative and enforcement measures, and a favorable tourism outturn.

Tax Revenue improved by $122.1 million (10.4 percent) to $1,291.5 million, strengthened by gains in international trade and transactions ($78.8 million to $412.3 million), Value Added Tax collections ($17.1 million to $663.1 million), and taxes on use and permission to use goods ($15.3 million to $63.0 million).

Additionally, non-tax revenue increased by $16.7 million (12.6 percent) to $149.4 million. Receipts were higher for property income by $6.9 million to $21.8 million, and for sales of goods and services, by $10.4 million at $123.3 million.

Expenditure increased by $278.3 million (17.8 percent) to a total of $1,839.1 million, with recurrent and capital expenditures amounting to $1,619.0 million and $220.1 million, respectively. Key drivers of recurrent expenditure included compensation of employees ($434.6 million), use of goods and services ($346.6 million), public debt interest ($335.5 million), and subsidies ($220.4 million). Capital expenditure saw a rise in capital transfers, which grew by $30.9 million, reaching $48.5 million. Additionally, the acquisition of non-financial assets increased to $171.5 million.

As a result of these developments, the deficit grew by $139.3 million (53.9 percent), reaching $398.1 million, which increased from $258.7 million experienced in the previous period.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Source: Ministry of Finance, The Bahamas

Date: March 13, 2025

Contact: Financemail@bahamas.gov.bs

In fulfillment of reporting requirements under the Public Debt Management Act, 2021, the Ministry of Finance is pleased to release the FY2025/26 to FY2027/28 Medium-term Debt Management Strategy (the “MTDS”). The MTDS is intended to guide the government’s borrowing decisions to fund its overall financing needs, at the lowest cost consistent with a reasonable degree of risk, while promoting the development of the domestic debt market.

In determining the optimal debt management strategy, the analysis considers the costs and risks embedded in the current debt portfolio, medium-term borrowing requirements, the government’s fiscal policy and strategy, the prevailing macroeconomic environment, market conditions and other relevant factors.

Three (3) alternative financing options were evaluated in terms of their cost risk profiles and subjected to various stress scenarios to determine their effectiveness in meeting the government’s debt management objectives. The selected strategy seeks to maximize use of domestic sources of financing to mitigate foreign currency risk and promote the development of the domestic capital market. Other features characterizing the optimal strategy include its use of more fixed rate instruments, extended maturities, and liability management operations to manage refinancing risk, lengthen the average time to maturity of the portfolio, and control interest rate risk, while balancing costs. The financing mix suggests gross external and domestic borrowings in the ratio of 20 percent and 80 percent, respectively.

The public is invited to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal and debt reports

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of December 2024, as mandated by the Public Finance Management Act, 2023.

During the review month, total revenue collections was estimated at $253.1 million, a $67.2 million (36.2 percent) improvement from the prior year. Tax collections expanded by $50.7 million (31.3 percent) to $212.8 million, and was associated with gains in taxes on use and permission to use goods (91.2 percent), taxes on international trade and transactions (74.8 percent), and value-added tax collections (17.8 percent). Non-tax revenue collections improved by $16.5 million (69.3 percent), with $12.8 million (77.5 percent) obtained from a combination of rental and dividend payments.

Recurrent spending of $271.7 million, represented a year-over-year increase of $42.3 million (18.4 percent). This growth was mainly explained by increases in public debt interest payments (56.6 percent), with transfers to other payments associated with transfers to non-financial public corporations (30.6 percent) and purchases of goods and services (28.0 percent). Capital outlays narrowed by 2.7 million (12.1 percent), led by a $2.2 million decline for acquisition of nonfinancial assets.

As a result of the above movements, the estimated deficit on the Government’s overall fiscal position for December 2024 narrowed, year-over-year, by $27.7 million (42.0 percent) to $38.3 million. Financing activities for the month featured an estimated decrease in the outstanding debt stock by $11.0 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

In keeping with Section 61 of the Public Debt Management Act, 2021, the December 2024 public debt statistical bulletin (“PDSB”) represents the fourteenth centralized collection of and dedicated publication on public debt statistics in The Bahamas prepared by the Debt Management Office (the “DMO”) of the Ministry of Finance

At end-December 2024, public sector debt outstanding was estimated at $13,150.0 million— corresponding to respective gains of $81.3 million (0.6%) and $312.8 million (2.4%) relative to endSeptember 2024 and the prior year. The central government’s net borrowing activities for the quarter increased its debt stock by $92.4 million (0.8%) to $11,748.7million, for a slightly lower estimated 79.2% of nominal GDP.

By currency composition, public sector foreign currency debt declined by $133.4 million (2.3%) to $5,716.7 million, to account for a reduced 43.5% of the total stock. Growth in the Bahamian Dollar component of $214.7 million (3.0%) to $7,433.3 million, represented a 1.3 percentage point rise in share to 56.5%.

Quarterly movements in external debt obligations were dominated by the central government’s US $300.0 million liability management exercise, which comprised $281.2 million in Eurobond repurchased in a public tender offer and $81.0 million in commercial bank debt. These transactions were in the context of the recently concluded debt conservation project for marine conservation which was financed through a new US $300 million commercial loan. As a consequence, the debt share of owing to private capital markets was reduced by 3.5 percentage points to 47.4%, while the $182.2 million net commercial borrowing broadened the exposure to financial institutions by 3.8 percentage points to 27.9% of the total. With steady net repayment positions, the respective shares for bilateral and multilateral creditors were lowered to 23.9% and 0.7%.

In domestic operations, the central Government’s debt stock expanded by $162.3 million (2.5%), with increased holdings of government paper elevating liabilities to the private sector by $107.3 million (4.2%). Debt owing to commercial banks and the Central Bank also grew, by $68.4 million (2.7%) and $20.0 million (2.0%), respectively, while that to the public corporations contracted by $33.4 million (8.3%)

Dissemination of timely, consistent, comprehensive, reliable and internationally comparable public debt statistics represents a key element of the Government’s commitment to promote accountability and transparency in debt management activities.

The Ministry invites domestic and international stakeholders to visit the national Budget Website (www.bahamasbudget.gov.bs) to view the various published reports.

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of November 2024, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $253.1 million, a 23.7 percent improvement from the prior year, with the tax component higher by $47.1 million at $230.5 million. Key gains were posted for taxes on international trade and transactions ($23.5 million) and property tax collections on a combination of commercial and foreign-owned undeveloped properties ($14.0 million)

Of the $335.5 million in aggregate expenditure, the recurrent and capital components stood at $281.9 million and $53.6 million, respectively. The $39.9 million year-over-year increase in recurrent expenses was primarily associated with higher outlays for the use of goods and services ($16.7 million) and subsidies ($10.1 million). Under capital spending, capital transfers, which constituted 52.6 percent of the total, expanded by $23.3 million.

Following on the above outcomes, the Government’s overall fiscal position for November 2024 resulted in an estimated deficit of $82.5 million, compared with a year-earlier deficit of $69.6 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $40.4 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of October 2024, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $256.0 million, a 3.1 percent improvement from the prior year, of which tax revenue rose by $15.8 million at $236.0 million. Key gains were dominated by value-added tax collections totaling $132.6 million and taxes on international trade and transactions of $67.0 million. Non-tax revenue collections totaled $19.8 million with $19.1 million obtained from the sale of goods and services.

Aggregate expenditure settled at $344.5 million, with the recurrent and capital components at $321.5 million and $23.0 million, respectively. The year-over-year $26.6 million increase in recurrent expenses was primarily associated with higher outlays on the use of goods and services ($27.0 million) relative to rental and utilities payments alongside the acquisition of various services. Under capital spending, the acquisition of non-financial assets, which makes up 95.6 percent of the total, expanded by $7.3 million.

As a result of the above movements, the Government’s overall fiscal position for October 2024 resulted in an estimated deficit of $88.6 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $54.7 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Preliminary data on the fiscal outcome for first quarter of FY2024/25 featured an improved revenue performance, aided by enhanced administrative and enforcement measures.

Total revenue collections were estimated at $682.2 million—a year-over-year boost of $18.7 million (2.8 percent), with the bulk of this gain emanating from tax receipts which stood at $616.2 million. Key improvements in the latter were registered for departure taxes ($26.4 million), business licenses ($7.5 million), stamp taxes on financial and realty ($6.7 million) and property taxes ($4.0 million), with some offset attributed to excise and gaming taxes. Non-tax revenue increased by $6.2 million (10.4 percent) to $66.0 million, and was associated with the incidence of higher intakes under immigration fees ($4.4 million), interest and dividend payments ($2.8 million) and customs fees ($1.3 million).

Aggregate expenditure expanded by $142.6 million (19.7 percent) to $867.7 million, with the recurrent and capital components at $743.9 million and $123.8 million, respectively. The $83.5 million (12.6 percent) gain in recurrent outlays was allocated among transfers ($25.2 million), and payments for the acquisition of services ($21.7 million), subsidies ($10.5 million) and rent ($8.8 million). Capital spending, which increased by $59.1 million (91.5 percent), incorporated elevated outlays for the acquisition of non-financial assets ($51.7 million).

Based on these developments, the central Government posted an increase in the overall

estimated deficit to $185.4 million (1.2 percent of GDP) from $61.5 million (0.4 percent of GDP) in the prior period. The debt stock was provisionally placed at $11,656.3 million—equivalent to 79.1 percent of estimated GDP.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of September 2024, as mandated by the Public Finance Management Act, 2023.

During the review month, revenue receipts totaled $187.5 million, a 4.2 percent decline from the prior year. Tax revenue accounted for $167.5 million and was dominated by value-added tax collections of $85.3 million and taxes on international trade and transactions of $55.2 million. Non-tax revenue collections totaled $20.1 million with $19.6 million obtained from the sale of goods and services.

Aggregate expenditure settled at $252.2 million, with the recurrent and capital components at $214.3 million and $37.9 million, respectively. The year-over-year $8.2 million decrease in recurrent expenses was primarily associated with lower interest payments ($10.5 million) and other transfers ($3.5 million). Under capital spending, the acquisition of non-financial assets, which makes up 81.5 percent of the total, expanded by $13.9 million.

As a result of the above movements, the Government’s overall fiscal position for September 2024 resulted in an estimated deficit of $64.7 million. Financing activities for the month featured an estimated decrease in the outstanding debt stock by $18.0 million.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

View press release below.

Source: Central Communications Unit, Ministry of Finance, The Bahamas

Date: November 8, 2024

Contact: MOFcomms@bahamas.gov.bs

In keeping with Section 61 of the Public Debt Management Act, 2021, the September 2024 public debt statistical bulletin (“PDSB”) represents the thirteenth centralized collection of and dedicated publication on public debt statistics in The Bahamas prepared by the Debt Management Office (the “DMO”) of the Ministry of Finance.

At end-September 2024, the stock of public sector debt was estimated at $13,026.8 million—representing respective gains of $338.7 million (2.7%) and $394.9 million (3.1%) vis-à-vis end-June 2024 and the comparative year-earlier period. Quarterly net financing activities elevated the central Government’s debt stock by $342.5 million (3.0%) to $11,656.3 million, and to an estimated 79.1% of nominal GDP from 77.6% at end-June 2024.

For the review quarter, public sector foreign currency debt grew by $124.8 million (2.2%) to $5,850.1 million, which corresponded to a moderately lower 44.9% share of the totalstock. Similarly, the Bahamian Dollar component expanded by $213.9 million (3.1%) to $7,176.7 million, for 55.1% of the outstanding debt.

Quarterly variations in external debt obligations were principally explained by the $162.2 million (14.0%) growth in the net exposure to financial institutions following on the central Government’s drawdown of a new EUR 200.0 million credit facility. Conversely, net repayment outcomes were registered for multilateral ($32.4 million), private capital markets ($5.4 million), and bilateral ($1.5 million) creditors.

Growth in public sector domestic debt operations featured a $118.6 million (13.5%) rise in the central Government’s indebtedness to the Central Bank, alongside a $53.7 million (1.9%) increase in the net exposure to commercial banks following the central Government’s access to a new $100 million commercial bank loan facility. Liabilities to the private sector also expanded by $39.3 million (1.5%), but those to the public corporations moderated by $9.9 million (1.4%).

Dissemination of timely, consistent, comprehensive, reliable and internationally comparable public debt statistics represents a key element of the Government’s commitment to promote accountability and transparency in debt management activities.

The Ministry invites domestic and international stakeholders to visit the national Budget Website (www.bahamasbudget.gov.bs) to view the various published reports.

November 7, 2024 — The Commonwealth of The Bahamas (the “Government”) announced today the commencement of an offer to purchase for cash, at a price to be determined pursuant to a modified Dutch auction, its outstanding series of notes listed in the table below (each a “Series” and collectively, the “Notes”) upon the terms and subject to the conditions described in the offer to purchase dated November 7, 2024 (the “Offer to Purchase”). The Government has offered to purchase for cash up to an aggregate consideration amount, with respect to all Series, of U.S.$210,000,000 (the “Maximum Aggregate Consideration Amount”), excluding accrued but unpaid interest, which will also be paid on the Notes accepted for purchase pursuant to the Offer (as defined below). The Maximum Aggregate Consideration Amount is subject to increase or decrease at the Government’s sole and absolute discretion at any time, on the terms and subject to the satisfaction of the Financing Condition (as defined below) and the other conditions set forth in the Offer to Purchase (the “Offer”).

Capitalized terms used in this announcement but not defined have the meanings given to them in the Offer to Purchase.

The Notes have an aggregate principal amount outstanding as set forth in the table below. In the event that the aggregate principal amount of the Notes of such Series validly tendered exceeds the Maximum Series Acceptance Amount (as defined below), the Government may accept the Notes of such Series on a pro rata basis such that the

aggregate principal amount of Notes accepted for purchase (if any) is no greater than the Maximum Series Acceptance Amount of such Series, subject to the proration procedures described in the Offer to Purchase.

All documentation relating to the Offer including the Offer to Purchase and any amendments or supplements thereto will be available to holders of the Notes (the “Noteholders”) via the Transaction Website for the Offer accessible at:

https://projects.sodali.com/bahamas, subject to eligibility confirmation and registration.

The Government is making the Offer only in those jurisdictions where it is legal to do so. See “Certain Legal Restrictions” in the Offer to Purchase.

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of August 2024, as mandated by the Public Finance Management Act, 2023.

Total revenue collections for the review month totaled $208.7 million, approximately 2.4 percent ($4.9 million) above the prior year’s collection and was associated with gains in tax collections on financial and capital transactions of $3.4 million (41.1 percent) and property tax collections of $0.5 million (9.7 percent). Tax revenue represented 88.4 percent of the total at $184.5 million.

Recurrent spending amounted to $231.5 million, representing a year-over-year increase of 18.4 percent ($43.2 million). This growth was mainly explained by higher outlays for subsidy payments ($27.5 million to $35.1 million), purchases of goods and services ($39.5 million to $45.4 million) and other payments ($17.7 million to $36.1 million). Capital spending expanded by 13.4 million to $47.2 million, with 76.5 percent employed for the acquisition of non-financial assets and 23.5 percent for capital transfers.

As a result of the above, Government’s deficit on the overall fiscal position widened to $70.1 million from $31.7 million in the corresponding period a year earlier.

Based on financing activities, the central Government’s outstanding debt increased by an estimated $49.2 million.

The Ministry of Finance is committed to the Government’s mandate of full transparency and timely reporting. The public is encouraged to visit the national Budget Website

(www.bahamasbudget.gov.bs) to view all fiscal reports.

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal

operations for the month of July 2024, as mandated by the Public Finance Management Act, 2023.

Revenue receipts for July 2024 were estimated at $276.7 million, an increase of 4.8 percent ($12.7 million) from the corresponding period in the prior year. Tax revenue accounted for $255.2 million of the total, and was dominated by value added tax collections which improved by $7.2 million to $154.1 million. Receipts from taxes on use & permission to use goods broadened by $10.3 million to $15.1 million, driven by gains in the business licence fee component. Of the $21.4 million in non-tax revenue, 96.9 percent was derived from the sale of goods and services—which was mainly comprised of immigration and customs related fees (79.0 percent).

Aggregate expenditure settled at $335.9 million, with the recurrent and capital components at $297.3 million and $38.7 million, respectively. The $61.0 million firming in recurrent expenses was primarily associated with higher outlays for the use of goods and services ($32.8 million), interest payments ($12.8 million), and other transfers ($12.0 million). Under capital spending, the acquisition of non-financial assets, which makes up 96.5 of the total, expanded by $26.2 million.

As a result of the above movements, the Government’s fiscal position for July 2024 resulted in an estimated deficit of $59.2 million. Financing activities for the month featured an estimated increase in the outstanding debt stock by $274.2 million, of which 45.6 percent was placed into the sinking fund.

The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

Please view the attached document

See file below for press release.

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of June 2024, as mandated by the Public Finance Management Act, 2023.

Total revenue for the review month was estimated at $235.0 million, a decrease of 3.3 percent from the corresponding period in the prior year. Tax revenue accounted for $204.4 million of the total, and was dominated by value added tax collections that improved by $8.8 million to $99.2 million. Receipts from international trade and transactions also showed gains of $20.3 million to $69.6 million. Meanwhile, non- tax revenue moderated by 55.6 percent to $30.6 million following the prior year’s boost provided by the receipt of dividend income from Bahamas Telecommunications Company Ltd. and tourism-related fees.

Aggregate expenditure settled at $270.6 million, with the recurrent and capital components at $245.6 million and $25.0 million, respectively. The $133.1 million reduction in recurrent expenses was largely explained by reductions in outlays for the use of goods and services ($98.2 million), subsidy payments ($19.4 million) and other transfers to public entities ($26.2 million). However, increased spending was posted for public debt interest payments ($16.2 million). Under capital, outlays for the acquisition of non- financial assets contracted by $52.6 million.

As a result of the above movements, the Government’s fiscal position for June reflected a significant reduction in the estimated deficit, to $35.6 million from $212.0 million a year earlier. Financing activities for the month featured an estimated decrease in the outstanding debt stock by $162.4 million.

The Ministry of Finance is committed to the Government’s mandate of full transparency and timely reporting. The public is encouraged to visit the national Budget Website (www.bahamasbudget.gov.bs) to view all fiscal reports.

The Ministry of Finance is pleased to release its monthly report on Government’s fiscal operations for the month of May 2024, as mandated by the Public Finance Management Act, 2023.

Fiscal operations benefitted from a strong revenue performance, with revenue receipts estimated at $287.5 million, an increase of 12.0 percent from the corresponding period in the prior year. Tax revenue accounted for $241.6 million of the total, and was dominated by value added tax collections which improved by $8.8 million to $107.7 million. Next in importance were receipts from international trade and transactions, with a gain of $12.6 million to $77.6 million. Of the $45.9 million in non-tax revenue, 49.3 percent was derived from the sale of goods and services—which was mainly comprised immigration and customs related fees (52.4 percent) and service charges (25.5 percent).